Legendary value investor Warren Buffet once famously said “Be fearful when others are greedy and greedy when others are fearful.” This piece of wisdom is probably very apt for the current time when the markets worldwide are going through a phase of uncertainties. It is normal for investors to feel panic and uncertainties when the broader market shows corrections. However, the phase of panic also brings many investment opportunities to value investors.

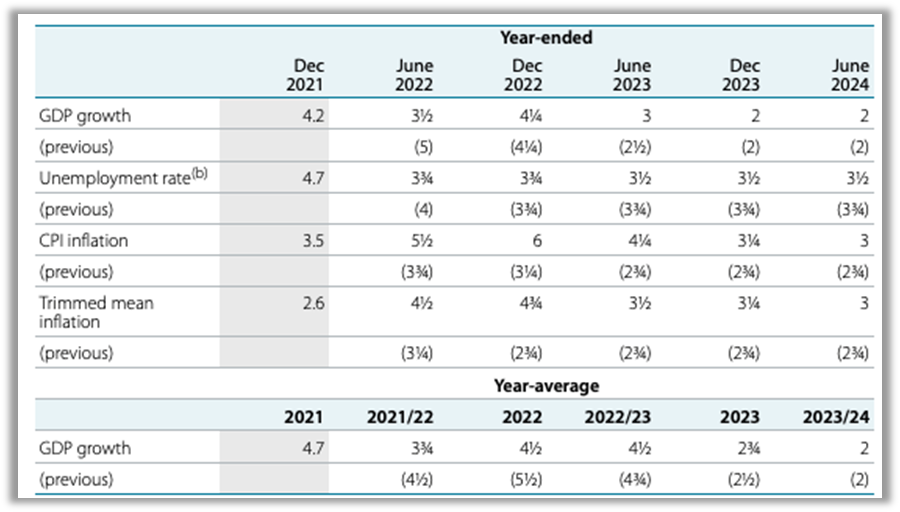

In spite of the ongoing uncertainties, our view is that the long-term growth potential of the Australian economy remains intact. According to the statement issued by RBA last week, ‘A strong expansion in the Australian economy is under way’ and the economy is projected to grow at 4.5% in the current financial year. Following data released by the RBA shows the growth rate is expected to be steady even though inflation is expected to remain elevated:

Source: Reserve Bank of Australia

The chart lays out the new growth forecast and the expected inflation data as compared to the previous estimates. It shows that the downward revision of the GDP figure is marginal and the economy is still expected to grow at a stable rate. However, the data forecasts a relatively high level of inflation compared to the previous estimates.

The long-term value investors will find the falling market as an opportunity to enter the market with a long investment horizon in mind. We advise investors to remain cautious and at the same time look for attractive valuations in the current period. We can find some signs of optimism amidst the ongoing uncertainties, which can potentially lead to market rebounds.

Some positive signs for investors:

- US inflation rate is showing signs of stabilization

Rising inflation has been a constant narrative in investment world in the current financial year. Investor’ worry about a high-inflation regime has been the main reason by current market corrections. However, world-wide inflation is expected to peak soon. Inflation data released on May 11 shows that year-on-year inflation in April was 8.3%, a slower growth the previous month (which was 8.5% year-on-year). This is an indication of inflation rate stabilization in economy, even though in absolute terms the inflation rate is still on the higher side. It also shows that the worst may be over. If the rate stabilizes and then starts falling, the Fed is likely to loosen its hawkish position. With a stabilization of inflation, investors’ sentiment is expected to turn positive, which can cause sharp market rebound.

- Market data suggests correction may be over soon

The market is seemed to have discounted most of the bad news and expectations – high inflation, high-interest rate, escalation of the Ukraine-Russia war and high commodity price. The majority of the correction probably has already happened. According to JPMorgan Chase & Co. strategists led by Marko Kolanovic “investor sentiment is reaching extreme weakness," indicating that a major market rebound is in the expected line. Moreover, an important sentiment indicator of Societe Generale SA recently fell to the level last seen in March 2020 – when the COVID crisis unfolded. This indicator suggests an impending bounce back of the equity market.

The US put-call ratio is currently at the highest level since January. It indicates there is a high-level of hedge build-up by investors. As investors unwind these positions, the equity market is expected to get a heavy lift in the upcoming months.

- Bear markets tend to last shorter than bull markets

A market is said to have entered a phase of bear market when the market corrects more than 20% from its recent high. The US indexes are trading near the bear-market zone even though the ASX 200 has not entered a true bear market because of regular pullbacks. Even if the ASX 200 enters a bear market, the good news is that a bear market tends to be much shorter than a bull market. An average bear market lasts for about 363 days whereas an average bull market lasts 1,742 days. According to data published by Invesco, the average loss in a bear market is around 33% whereas an average gain in a bull market is 159%.

- Some market segments are performing relatively better than others

When the market corrects, all sectors are not expected to perform in the similar line. There are pockets of safe havens in the market in sectors like utility, energy, and metal. Investors can park a significant portion of their money in the sectors which experience stable sales such as consumer goods companies and utilities companies. Because of stability, these sectors are also considered inflation hedges. Rising price of energy and commodities make energy, metal and commodity firms safe investment bets.

Many brokerage firms are increasing their number of ‘buy’ ratings in the ASX 200. According to data collected by FNArena, out of 437 stocks recommendations by different brokers, 60% are buy recommendations whereas sell recommendations are around 5%.

Amidst these signs of optimism, we have identified the sectors which are most likely to outperform in the next few months when the market rebounds.

Sectors To Invest in the ASX 200

A falling market often presents huge investment opportunities for the long-term investors. A value-conscious investors can find stocks with attractive valuations and long-term growth potential. Here are two sectors that are expected to create great investment value:

Mining

After the recent market corrections, ASX 200 mining shares are showing attractive valuations. As the economy continue rebounding, there will be a greater demand for energy. Therefore, commodities required in electrification are going to experience a surge in demand. The ASX 200 mining shares experienced stellar performance in 2021 but lagged in 2022, creating opportunities for re-entry.

Mining Shares like lithium producer Allkem Ltd (ASX:AKE); gold, nickel and copper producer Oz Minerals Limited (ASX: OZL) and rate earth producer Lynas Rare Earths Ltd (ASX: LYC) have corrected between 11% to 15% in last one month compared to the 6.3% fall in the ASX 200 index. According to analysts at Canaccord, “Looking through the short-term volatility, we see the recent pullback as an opportunity to invest in sector leaders with robust balance sheets and near-term earnings growth/positive free cashflow yields, particularly those with leverage to attractive long-term supply/demand fundamentals such as Allkem, Lynas Rare Earths, and Oz Minerals.”

Technology

The ASX 200 tech shares are among the most beaten down shares in the recent sell-off. The ASX 200 tech sector as a whole has come down by nearly 16% in the previous one month. After the market crash during covid pandemics, the technology shares outperformed the broader market because of a shift towards work-from-home culture. The recent sell-off is an opportunity to make entry in some of the beaten-down tech stocks as we believe the work-from-home culture is a permanent shift.

A number of tech-shares are currently trading at a lower price than the long-term historical average. Technology companies like Appen Ltd (ASX: APX), Block Inc CDI (ASX: SQ2) and Nearmap Ltd (ASX:NEA) can be value buy. These sticks are currently trading below the ASX 300 IT historical average.

In addition to these sectors, investors can manage risks by adding some stocks with high dividend yields to earn safe income.

High dividend-yield stocks

In uncertain times, high dividend paying stocks can be safe bets for investors as there will be steady dividend income. Dividend-paying stocks are also good hedge against high inflation.

BHP Group Ltd (ASX:BHP) has a high level of free cashflows. Also, the firm is experiencing favorable commodity price. Its shares recently got ‘buy’ ratings from the Citi group. The dividend yields of the firms is expected to be 10.8% in FY 2022 and 10.9% in 2023.

Similarly, National Australian Bank (ASX:NAB) is expected to provide dividends of 4.9% in FY 2022 and 5.35% in FY 2023.

Overall, a falling market can prove to be a good time to enter the market rather than sitting on cash.

Veye Pty Ltd(ABN 58 623 120 865), holds (AFSL No. 523157 ). All information provided by Veye Pty Ltd through its website, reports, and newsletters is general financial product advice only and should not be considered a personal recommendation to buy or sell any asset or security. Before acting on the advice, you should consider whether it’s appropriate to you, in light of your objectives, financial situation, or needs. You should look at the Product Disclosure Statement or other offer document associated with the security or product before making a decision on acquiring the security or product. You can refer to our Terms & Conditions and Financial Services Guide for more information. Any recommendation contained herein may not be suitable for all investors as it does not take into account your personal financial needs or investment objectives. Although Veye takes the utmost care to ensure accuracy of the content and that the information is gathered and processed from reliable resources, we strongly recommend that you seek professional advice from your financial advisor or stockbroker before making any investment decision based on any of our recommendations. All the information we share represents our views on the date of publishing as stocks are subject to real time changes and therefore may change without notice. Please remember that investments can go up and down and past performance is not necessarily indicative of future returns. We request our readers not to interpret our reports as direct recommendations. To the extent permitted by law, Veye Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss, or data corruption) (as mentioned on the website www.veye.com.au), and confirms that the employees and/or associates of Veye Pty Ltd do not hold positions in any of the financial products covered on the website on the date of publishing this report. Veye Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services.