Inflation is rising and it is expected to remain elevated

Rising inflation and a subsequent hike in the interest rates is the new talk of the town. Inflation numbers have created uncertainty among equity investors. Given this current situation, one needs to find out the best strategy to hedge as well as earn sufficient returns from equity investment.

After a classic V-shaped recovery post COVID pandemic, the central banks around the world have been posed with a new challenge – fighting the hydra of rising inflation. In the USA, inflation rose to 8.4% over the year at the end of March 2022. This was the highest year-on-year inflation in the country since December 1981.

Unprecedented amount of government stimulus has been primarily instrumental in increasing the inflationary pressure. The recent Russia-Ukraine conflict has put further pressure on energy and food prices, which have contributed to the unexpected inflation numbers. Given the larger-than-expected inflation numbers, the Fed was prompted to press the panic button panicking equity investors. The Fed, in its recent policy meetings, declared to increase the benchmark interest rates faster than expected.

In Australia, the consumer prices in the last quarter increased at the fastest annual rate in the last two decades. The general price level has increased mainly because of a rise in the prices of energy, food and commodities. The Consumer Price Index (CPI) jumped 2.1% in the first quarter, surpassing the market expectation of a 1.7% rise. The rising inflation puts pressure on the Reserve Bank of Australia (RBA) to increase interest rates and achieve price stability.

The interest rate is expected to go up

The Central Bank of Australia on May 3 raised its benchmark interest rate from 0.1% to 0.35%. This was the first interest rate hike in more than 11 years. The main reason behind the rate hike is to keep the inflation rate within the target band of 2-3%. The interest rate hike was in the expected line and it is unlikely to shock the equity market further.

Interest rates have been kept historically low by central banks of most major economies to deal with the COVID-19 pandemic. But given an inflationary environment, the US Fed increased its benchmark interest rates by 50 basis point on May 4. This was the second instance of rate increase by the Fed. Earlier it increased interest rates by 25 basis point in March 2022.

Uncertainty led to market corrections

High inflation numbers and the recent geo-political developments have created uncertainty among the investors. Investors’ cautious approach is evident from the recent market corrections. As of the closing price of the month of April, the Dow Jones was down 4.9% in whereas the tech-heavy NASDAQ and the S&P 500 were down by 13.3% and 8.8% respectively. As per the market close of 2 May, the ASX 200 is trading 3.2% lower Year-to-Date.

Clearly, investors will have to find opportunities in different pockets of the market which can outperform in an inflationary environment. Holding cash is not a profitable option because inflation erodes the purchasing power of cash in hand. The market corrections have presented opportunities in different market segments where valuations have been lucrative again.

Inflation is not essentially bad news for equity investors

When there is an increase in the price level, firms are expected to earn a higher revenue and report better results. Historically, the equity market has proved to be an efficient hedge against the rising price level. A moderate level of inflation is a positive sign for the equity market because moderate inflation is associated with economic growth, higher profits and a higher purchasing power.

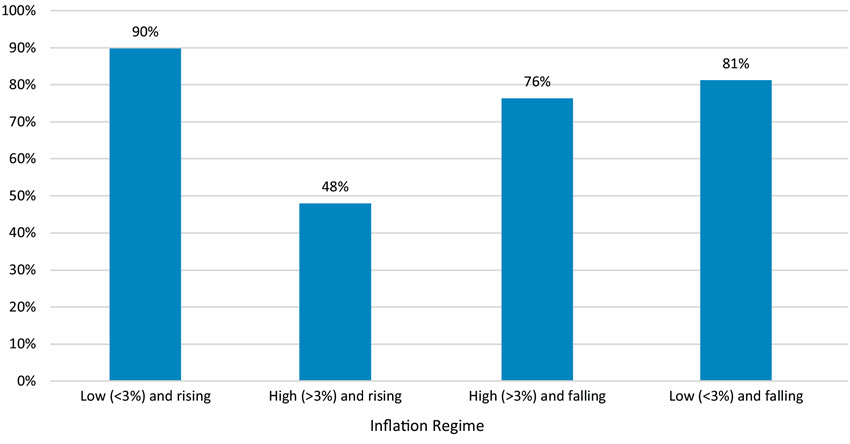

Historical data shows that equity investment outperformed inflation 90% of time when inflation is below 3% and rising. The following graph shows relevant data associated with inflation and equity returns:

The graph has been taken from schroders.com.

Market data suggests most of the uncertainties have been discounted

The recent market corrections indicate that most investors’ uncertainty regarding inflation have been discounted by the market. The majority of the correction seem to have already happened. According to JPMorgan Chase & Co. strategists led by Marko Kolanovic “investor sentiment is reaching extreme weakness," indicating that a major market rebound is in the expected line. Moreover, an important sentiment indicator of Societe Generale SA recently fell to the level last seen in March 2020 – when the COVID crisis unfolded. This indicator suggests an impending bounce back of the equity market.

The US put-call ratio is currently at the highest level since January indicating a high level of hedge build-up by investors. As investors unwind these positions, the equity market is expected get a heavy lift in the upcoming months.

Sectors to focus in an inflationary environment

Some sectors are expected to perform better than others in an inflationary environment given the unique positions of the businesses. Following are some important sectors that have often outperformed during high inflation:

Financials

Financial tend to perform better in a high-interest rate environment because of better cashflows. Also, the net interest income of banks rises when the interest rates go up.

Utility

Utility companies tend to have a stable revenue because of the nature of their business. Because of the high level of stability in performance, utility stocks are often treated as proxies of bonds. Also, utility companies are able to pass the rising costs to the consumers more conveniently. These are the reasons that make utility companies good investment bets during an uncertain economic environment.

Insurance

There is a linear relationship between interest rates and performance of insurance companies. This means when the interest rates go up, insurance companies tend to perform better. Also, higher sales in real estate means more insurance contracts and better top line for the insurance companies.

Therefore, wisdom lies in looking beyond the inflation numbers and find investment opportunities in the current market.

At Veye, we cover top ASX companies having the potential to deliver substantial returns. Subscribe to our hot sector report if you are keen to invest in stocks that are anticipated to grow at a rate significantly above the average growth of the market.

Veye Pty Ltd(ABN 58 623 120 865), holds (AFSL No. 523157 ). All information provided by Veye Pty Ltd through its website, reports, and newsletters is general financial product advice only and should not be considered a personal recommendation to buy or sell any asset or security. Before acting on the advice, you should consider whether it’s appropriate to you, in light of your objectives, financial situation, or needs. You should look at the Product Disclosure Statement or other offer document associated with the security or product before making a decision on acquiring the security or product. You can refer to our Terms & Conditions and Financial Services Guide for more information. Any recommendation contained herein may not be suitable for all investors as it does not take into account your personal financial needs or investment objectives. Although Veye takes the utmost care to ensure accuracy of the content and that the information is gathered and processed from reliable resources, we strongly recommend that you seek professional advice from your financial advisor or stockbroker before making any investment decision based on any of our recommendations. All the information we share represents our views on the date of publishing as stocks are subject to real time changes and therefore may change without notice. Please remember that investments can go up and down and past performance is not necessarily indicative of future returns. We request our readers not to interpret our reports as direct recommendations. To the extent permitted by law, Veye Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss, or data corruption) (as mentioned on the website www.veye.com.au), and confirms that the employees and/or associates of Veye Pty Ltd do not hold positions in any of the financial products covered on the website on the date of publishing this report. Veye Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services.