ASX Critical Minerals Stocks In Focus With Australia Emerging As Sector Leader

Get your Free Report on Top 5 ASX stocks for 2025

Get your Free Report on Top 5 ASX stocks for 2025

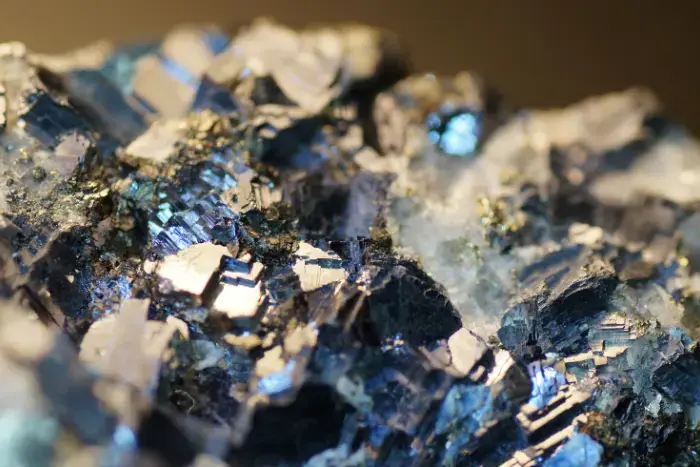

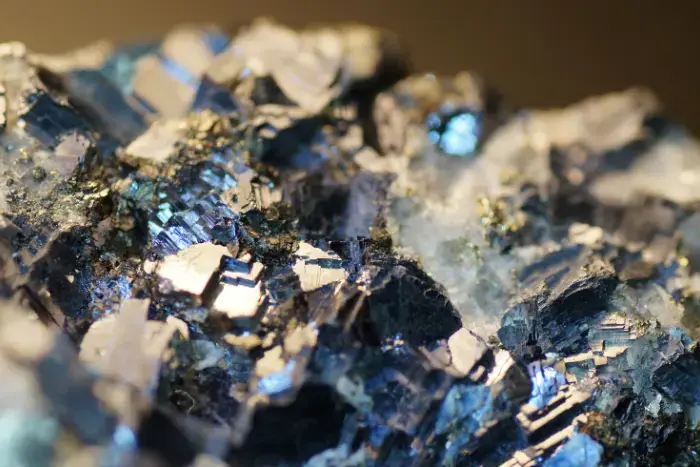

Australia is growing its critical minerals sector to make the country a world-leading producer of raw and processed critical minerals. Critical minerals are needed to make the critical technologies modern economies rely upon. And Australia is known to be home to some of the largest recoverable critical minerals deposits on earth.

Lynas Rare Earths Limited (ASX: LYC)

has demonstrated robust growth in FY25 from capacity expansion to profitable commercial execution. The operations at MT Weld extended nameplate capacity of 12k tonnes per annum of NdPr. LYC is progressing with the ramp-up of the Kalgoorlie Rare Earths processing plant and capacity enhancements at Lynas Malaysia. Kalgoorlie processing plant has the capacity to produce MREC to support around 9k tonnes of NdPr finished product and is now ramping up output as feedstock for Malaysia plant. Lynas has delivered sales revenue of $556.5 million, EBITDA of $101.2 million and NPAT of $8 million in FY25. The production remained in line with the previous year, reporting at 10,462 tonnes of REO and 6558 tonnes of NdPr. The demand for NdPr is increasing globally, which creates a favourable outlook for the company.

Iluka Resources Limited (ASX: ILU)

has successfully achieved its production guidance with ZIC (zircon, rutile, and synthetic rutile) production of 220k tonnes. Cataby and Jacinth-Ambrosia mines have delivered higher volumes at lower costs. The company has resilient margins underscored by disciplined cost management and product mix, with Net profit after tax of $92 million. It has reported minerals sands revenue of $558 million despite of global economic uncertainity. Moreover, it is progressing with Eneabba rare earths refinery and has also entered with Lindian Resources for supply of feedstock. ILU is on track with its Balranald project, with mining expected to start in the fourth quarter of 2025.

Arafura Rare Earths Limited (ASX: ARU)

has received $200 million of funding commitment from the National Reconstruction Fund Corporation (NRFC) for the development of its Nolans project. This project has a production capacity of 4440 tonnes per annum of NdPr oxide and has a long mine life of 38 years. It has projected post tax NPV of USD1.7 billion and pre finance IRR of 17.2 percent under base case. The company has secured offtake agreements with their one customer, Hyundai and Kia, Siemens Gamesa Renewable Energy, and a global trading group. ARU has cash position of $27 million as of June 2025 and has potential funds to move forward with its operations.

Pilbara Minerals Limited (ASX: PLS)

has maintained upward momentum supported by robust performance. Revenue recorded during the year was $769 million, and the Underlying EBITDA of $97 million. The company has shown operational progress with the expansion of production capacity of the P1000 Project, and the Mineral Resource update increases the contained lithium by 23 percent. Construction of the Mid Midstream plant has recommenced with the support of WA government funding. It has acquired Colina project in Brazil diversifying its operations. PLS has strong prospects for the future with FY26 guidance stating lower capex, reduced costs and high volumes.

FAQ About ASX Critical Minerals Stocks

What are the critical minerals?

Critical Minerals act as raw materials for clean technologies. For example they are used in electric car batteries, electric grids, etc. Resources like copper, lithium, cobalt, manganese and graphite are crucial to battery performance. Rare earth elements are important for permanent magnets used in wind turbines and EV motors.

What critical minerals are in Australia?

Australia is endowed with high geological potential in minerals such as cobalt, gallium, germanium, lithium, magnesium, manganese, nickel, rare earth elements, scandium, silicon, tantalum, titanium, tungsten, vanadium, and zirconium. The nation also holds moderate potential in antimony, arsenic, beryllium, bismuth, chromium, fluorine, graphite, hafnium, indium, molybdenum, and platinum group elements. Resources like niobium, rhenium, selenium, and tellurium remain in the unknown potential category, where geological understanding and production capacity are still developing.

What are the top 10 critical minerals?

-

Lithium

-

Rare earth elements

-

Nickel

-

Cobalt

-

Manganese

-

Vanadium

-

Titanium

-

Tungsten

-

Zirconium

-

Scandium

(Source: Company Announcements)

Latest Article

Checkout Our Recommendation for free - 7 days free trial

Start Free TrialDisclaimer

Veye Pty Ltd(ABN 58 623 120 865), holds (AFSL No. 523157 ). All information provided by Veye Pty Ltd through its website, reports, and newsletters is general financial product advice only and should not be considered a personal recommendation to buy or sell any asset or security. Before acting on the advice, you should consider whether it’s appropriate to you, in light of your objectives, financial situation, or needs. You should look at the Product Disclosure Statement or other offer document associated with the security or product before making a decision on acquiring the security or product. You can refer to our Terms & Conditions and Financial Services Guide for more information. Any recommendation contained herein may not be suitable for all investors as it does not take into account your personal financial needs or investment objectives. Although Veye takes the utmost care to ensure accuracy of the content and that the information is gathered and processed from reliable resources, we strongly recommend that you seek professional advice from your financial advisor or stockbroker before making any investment decision based on any of our recommendations. All the information we share represents our views on the date of publishing as stocks are subject to real time changes and therefore may change without notice. Please remember that investments can go up and down and past performance is not necessarily indicative of future returns. We request our readers not to interpret our reports as direct recommendations. To the extent permitted by law, Veye Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss, or data corruption) (as mentioned on the website www.veye.com.au), and confirms that the employees and/or associates of Veye Pty Ltd do not hold positions in any of the financial products covered on the website on the date of publishing this report. Veye Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services.