Bellevue Gold Bears The Brunt of Gold Price Drop

Team Veye | 26-Jul-2024

Bellevue Gold Limited (ASX: BGL) endures the deep losses in gold prices. After hitting record highs earlier this month, the commodity market volatility took its toll.

The company while revealing its 5 year growth plan this day, received firm commitments for a A$150 million fully underwritten share placement to institutional investors.

Strategising to accelerate growth, it looks for financial flexibility lower costs and increase margins. The placement expected to help in de-gearing to unlock operating cash flows for investment in FY25.

The fall in gold prices does not present a gloomy look as with easing inflation, central bank is expected to keep rates steady and indicate a rate cut in September which could be a positive for gold and precious metals.

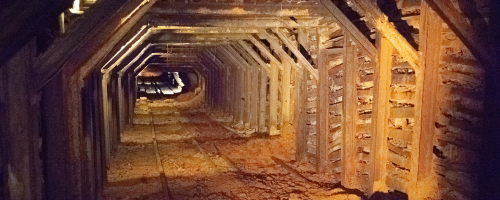

The execution of its 5 Year Growth Plan will endorse Bellevue’s credentials as a leading high-grade low cost ASX Australian gold producer and position it as one of only seven gold projects in the world producing +200,000oz at 5 g/t gold or more in a Tier One jurisdiction.

Source: Company's Report

Disclaimer

Veye Pty Ltd(ABN 58 623 120 865), holds (AFSL No. 523157 ). All information provided by Veye Pty Ltd through its website, reports, and newsletters is general financial product advice only and should not be considered a personal recommendation to buy or sell any asset or security. Before acting on the advice, you should consider whether it’s appropriate to you, in light of your objectives, financial situation, or needs. You should look at the Product Disclosure Statement or other offer document associated with the security or product before making a decision on acquiring the security or product. You can refer to our Terms & Conditions and Financial Services Guide for more information. Any recommendation contained herein may not be suitable for all investors as it does not take into account your personal financial needs or investment objectives. Although Veye takes the utmost care to ensure accuracy of the content and that the information is gathered and processed from reliable resources, we strongly recommend that you seek professional advice from your financial advisor or stockbroker before making any investment decision based on any of our recommendations. All the information we share represents our views on the date of publishing as stocks are subject to real time changes and therefore may change without notice. Please remember that investments can go up and down and past performance is not necessarily indicative of future returns. We request our readers not to interpret our reports as direct recommendations. To the extent permitted by law, Veye Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss, or data corruption) (as mentioned on the website www.veye.com.au), and confirms that the employees and/or associates of Veye Pty Ltd do not hold positions in any of the financial products covered on the website on the date of publishing this report. Veye Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services.