Source: Yahoofinance.com

WA1 Resources Ltd. (ASX: WA1) is a resource exploration company that owns 100% of three West Australian exploration projects prospective for copper and gold: the West Arunta Project, the Madura Project, and the Hidden Valley Project.

WA1's objective is to discover a Tier 1 deposit in WA’s underexplored regions and create value for all stakeholders.

The outstanding delivery of a 1-year return of approximately 590% is a testament to this. Just because a business cannot turn positive financial numbers, it does not mean that the stock will go down. By way of example, WA1 Resources Limited astonishingly surprised and delighted many shareholders. However, history lauds those rare successes.

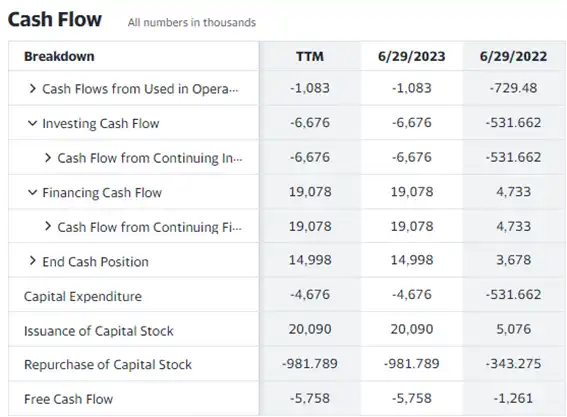

So, notwithstanding the buoyant share price, it’s well worth asking whether WA1's cash burn is too risky. Let’s consider the company's annual negative free cash flow, henceforth referring to it as the 'cash burn'.

Source: Yahoofinance.com

*All Data has been sourced from Company announcements and Refinitiv, Thomson Reuters

“While the past is always worth analyzing and realizing from the 5-year track record, it is the future that matters the most to all investors. For that reason, it makes a lot of sense to take a look at the fundamentals.”

Someone can calculate a company's cash runway by dividing the amount of cash it has by the rate at which it is spending that cash. When WA1 Resources last reported its balance sheet in June 2023, it had zero debt and cash worth $17 million.

Importantly, its cash burn (cash outflow) was $5.8 million over the trailing twelve-month period. That's a decent amount of capital allocation (growth capex), giving the company a couple years to develop its business. Because WA1 Resources isn't currently generating revenue, it has been considered an early-stage business. So while we can't look to sales to understand growth, we can look at how the cash burn is changing to understand how expenditures are trending over time. It is a real fact that the company increased its cash burn by approximately 357% in the last year. As the capex built up has seen a massive rise, it will lead to a rapid shrink in cash as it depletes its cash reserves.

Now that it is time to understand and realize the factual cash burn trajectory of the company, WA1 Resources shareholders may consider how smoothly it could raise more cash despite having a massive cash burn. There are ways that companies can raise finance through either debt or equity issuance. Many companies end up issuing new shares to fund future growth. By comparing a company's annual cash burn to its total market capitalization, we can estimate roughly how many shares it would have to issue in order to run the company for another year.

Since it has a market capitalization of approximately $364 million, WA1 Resources' $5.8 million in cash burn equates to about 1.6% of its market value. That means that it still has room for further issuance of new shares to fund more growth and might well be in a position to borrow cheaply.

Frequently Asked Questions (F.A.Q)

Is WA1 Resources a good buy?

WA1 is a highly volatile stock that is reflecting a 5-year monthly beta of 2.9, which indicates a very high-risk bet. The stock has already moved up while having negative earnings. The fundamentals have less potential; the market turmoil may trigger the stock’s price to fall precipitously.

What does WA1 Resources (ASX: WA1) do?

WA1 Resources Ltd. (ASX: WA1) is a resource exploration company that owns 100% of three West Australian exploration projects prospective for copper and gold: the West Arunta Project, the Madura Project, and the Hidden Valley Project.

WA1's objective is to discover a Tier 1 deposit in WA’s underexplored regions and create value for all stakeholders.

How do I calculate a company’s cash runway?

Someone can calculate a company's cash runway by dividing the amount of cash it has by the rate at which it is spending that cash.

Veye Pty Ltd(ABN 58 623 120 865), holds (AFSL No. 523157 ). All information provided by Veye Pty Ltd through its website, reports, and newsletters is general financial product advice only and should not be considered a personal recommendation to buy or sell any asset or security. Before acting on the advice, you should consider whether it’s appropriate to you, in light of your objectives, financial situation, or needs. You should look at the Product Disclosure Statement or other offer document associated with the security or product before making a decision on acquiring the security or product. You can refer to our Terms & Conditions and Financial Services Guide for more information. Any recommendation contained herein may not be suitable for all investors as it does not take into account your personal financial needs or investment objectives. Although Veye takes the utmost care to ensure accuracy of the content and that the information is gathered and processed from reliable resources, we strongly recommend that you seek professional advice from your financial advisor or stockbroker before making any investment decision based on any of our recommendations. All the information we share represents our views on the date of publishing as stocks are subject to real time changes and therefore may change without notice. Please remember that investments can go up and down and past performance is not necessarily indicative of future returns. We request our readers not to interpret our reports as direct recommendations. To the extent permitted by law, Veye Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss, or data corruption) (as mentioned on the website www.veye.com.au), and confirms that the employees and/or associates of Veye Pty Ltd do not hold positions in any of the financial products covered on the website on the date of publishing this report. Veye Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services.