The Future of Uranium Energy in Australia And Investment Opportunities.

The exploration and development of new uranium deposits is on the rise globally as stronger prices draw capital towards the sector. The opening of the Honeymoon mine in South Australia is expected to boost exports. Boss Energy’s Honeymoon mine is expected to reopen by the end of 2023. The mine has been in care and maintenance since 2013, but is expected to produce around 1,100–1,200 tons of uranium per year for at least ten years. Boss Energy Limited (ASX: BOE) recently announced the completion of its first wellfield at the site. Other construction projects, including the water treatment plants and gypsum pond, are also close to completion. As per the Australian government's Department of Industry Science and Resources, higher prices and production are expected to see export earnings surpass $950 million by 2024–25. Prices are also motivating renewed exploration, with exploration spending doubling over the past year to reach $13 million in the June quarter of 2023. Exploration and development of new uranium deposits are on the rise globally as stronger prices draw capital towards the sector. As such, prices will likely keep rising as demand grows relative to output.

Uranium Price:

Uranium prices have managed to reach a level that was not seen in the last 15 years, an unprecedented move that crossed the $80 per pound threshold. There are various factors that influenced the price-up move, such as a renewed interest in nuclear power and various supply disruptions in the global uranium market. Nymex futures, which track physical-market contracts for yellowcake, reached $80.25 per pound, up by 8.45% on Monday, reflecting a remarkable price increase.

Outlook:

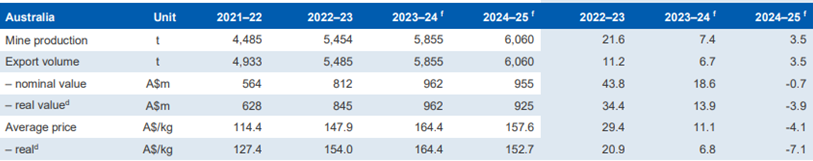

As per the resources and energy quarterly report for September 2023, export earnings forecasts for 2023–24 and 2024–25 are $90 million and $35 million, respectively. This reflects a recent strengthening in the price outlook.

Source: Australian Government; Department of Industry, Science, and Resources.

Reference: Data collection has been sourced from the Resources and Energy quarterly report, March 2023, published by the Australian government department of industry, science, and resources (www.industry.gov.au/req).

Investment Opportunities:

A renowned fund manager, Langsford, takes care of a $175 million natural resources fund at Terra Capital, foresees an exponential up move in equities based on uranium.

There are also some significant players in the Australian landscape who are heavily engaged in the exploration and development of uranium. Let's look at them here:

The global concerns over climate change have been the major issues, and nuclear power could soon emerge as a widely accepted form of clean energy. Here are the popular ASX-listed uranium stocks, as follows:

Paladin Energy Limited (ASX: PDN)

Paladin Energy Limited (ASX: PDN) has a market cap of $3.03 billion and a current market price of $1.015 (As of 27 September 2023). It is a uranium production and exploration company with projects currently in Australia, Canada, and Africa. The Langer Heinrich Mine in Namibia is its flagship project.

Deep Yellow Limited (ASX: DYL)

Deep Yellow Limited (ASX: DYL) has a market cap of $866.49 million and a current market price of $1.143 (As of 27 November 2023). It is developing through a combination of its existing assets and expanding its opportunities for diversified growth through sector consolidation.

Boss Energy Limited (ASX: BOE)

Boss Energy Limited (ASX: BOE) has a market cap of $1.57 billion and a current market price of $4.44 (As of 27 November 2023). It is a mineral exploration company with a focus on the Honeymoon Uranium Project in South Australia.

Frequently Asked Questions (F.A.Q)

What is the future of uranium globally?

Global demand for uranium is rising as nuclear deployments continue to trend up and as utilities seek to build stocks ahead of a potential supply shortfall in the mid-2020s. Uranium consumption is set to be supported by growing demand in China and other parts of Asia, North America, and Eastern Europe.

What is the outlook for uranium in 2030?

As per the Australian government's Department of Industry Science and Resources, higher prices and production are expected to see export earnings surpass $950 million by 2024–25. Prices are also motivating renewed exploration, with exploration spending doubling over the past year to reach $13 million in the June quarter of 2023.

Will Boss Energy become Australia's next uranium producer?

Boss Energy’s Honeymoon mine is expected to reopen by the end of 2023. The mine has been in care and maintenance since 2013, but is expected to produce around 1,100–1,200 tonnes of uranium per year for at least ten years. Boss Energy Limited (ASX: BOE) recently announced the completion of its first wellfield at the site. Other construction projects, including the water treatment plants and gypsum pond, are also close to completion.

Is uranium a good investment for the future?

The combination of various factors supports the better future aspects of uranium, such as the sentiments for rising demand for nuclear power and the supply and demand scenario of the industry.

Veye Pty Ltd(ABN 58 623 120 865), holds (AFSL No. 523157 ). All information provided by Veye Pty Ltd through its website, reports, and newsletters is general financial product advice only and should not be considered a personal recommendation to buy or sell any asset or security. Before acting on the advice, you should consider whether it’s appropriate to you, in light of your objectives, financial situation, or needs. You should look at the Product Disclosure Statement or other offer document associated with the security or product before making a decision on acquiring the security or product. You can refer to our Terms & Conditions and Financial Services Guide for more information. Any recommendation contained herein may not be suitable for all investors as it does not take into account your personal financial needs or investment objectives. Although Veye takes the utmost care to ensure accuracy of the content and that the information is gathered and processed from reliable resources, we strongly recommend that you seek professional advice from your financial advisor or stockbroker before making any investment decision based on any of our recommendations. All the information we share represents our views on the date of publishing as stocks are subject to real time changes and therefore may change without notice. Please remember that investments can go up and down and past performance is not necessarily indicative of future returns. We request our readers not to interpret our reports as direct recommendations. To the extent permitted by law, Veye Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss, or data corruption) (as mentioned on the website www.veye.com.au), and confirms that the employees and/or associates of Veye Pty Ltd do not hold positions in any of the financial products covered on the website on the date of publishing this report. Veye Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services.