Up until 2025, the construction of significant infrastructure in strategic areas and the ongoing adoption of EVs in the global automotive industry are expected to contribute to an annual growth rate of 1.9% in copper consumption.

It is projected that through 2025, the world's output of refined copper will increase by about 0.7% per year. India and China are anticipated to lead this with new capacity buildouts. Massive copper reserves are found in Australia.

Source: Department of Industry, Science and Resources.

Here are a few of the ASX Copper stocks that are actively involved in copper production both domestically and internationally. These are listed in the following order:

Chalice Mining Limited (ASX: CHN)

Market capitalization: $476.48 million

CMP: $1.225

Chalice Mining Limited specializes in mineral exploration and Platinum Group Element-Nickel-Copper-Cobalt-Gold discovery. Pyramid Hill Gold Project, Julimar Nickel-Copper-PGE Project, and Hawkstone Nickel-Copper-Cobalt Project are among the company's current projects.

Xanadu Mines Limited (ASX: XAM)

Market capitalization: $69.73 million

CMP: $0.041

Xanadu Mines Limited owns a number of significant exploration projects in the South Gobi Desert. It maintains a globally significant copper-gold deposit in its flagship Kharmagtai project.

Sandfire Resources Limited (ASX: SFR)

Market capitalization: $3.58 billion

CMP: $7.825

Sandfire Resources Limited is a top mining and exploration company in Australia. The primary business divisions of the company are the Motheo copper projects, the Black Butte project, the DeGrussa copper operations, and the Minas de Aguas Tenidas copper operations.

Reference: *All Data has been sourced from Company announcements and Refinitiv, Thomson Reuters

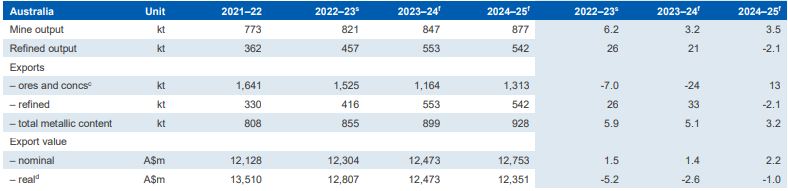

Australia copper industry Outlook (Export Volume, Export earnings & Production).

It is projected that Australian exports will increase even more, to approximately 928,000 tons in 2024–2025. Increases in export volumes are anticipated to help generate about $12.8 billion in export revenue in 2024–2025. It is anticipated that mined production will increase by approximately 877,000 tons in 2024–2025. It is also projected that Australia will produce 540,000 tons of refined copper by 2024–2025, an increase of about 8.9% per year.

Source: Department of Industry, Science and Resources.

Frequently Asked Questions (F.A.Q.)

Due to the abundance of copper resources available in Australia, Australian businesses are notably contributing to economic growth. Sandfire Resources Limited, Chalice Mining Limited, Zimplates Holdings Limited, and Evolution Mining Limited are a few examples of the best copper stocks ASX.

What is the copper industry outlook?

It is anticipated that until 2025, the world's consumption of copper will increase by 1.9% a year due to significant infrastructure projects that are either planned or under way in strategic locations, especially in the energy sector, and the ongoing adoption of electric vehicles (EVs) in the global auto industry. It is anticipated that the production of refined copper will reach approximately 27.1 million metric tons in 2023 and increase by approximately 0.7% a year until 2025.

The Australian copper stocks are as follows:

-

Chalice Mining Limited.

-

Western Areas Limited.

-

Syrah Resources Limited.

-

Metals X Limited.

Veye Pty Ltd(ABN 58 623 120 865), holds (AFSL No. 523157 ). All information provided by Veye Pty Ltd through its website, reports, and newsletters is general financial product advice only and should not be considered a personal recommendation to buy or sell any asset or security. Before acting on the advice, you should consider whether it’s appropriate to you, in light of your objectives, financial situation, or needs. You should look at the Product Disclosure Statement or other offer document associated with the security or product before making a decision on acquiring the security or product. You can refer to our Terms & Conditions and Financial Services Guide for more information. Any recommendation contained herein may not be suitable for all investors as it does not take into account your personal financial needs or investment objectives. Although Veye takes the utmost care to ensure accuracy of the content and that the information is gathered and processed from reliable resources, we strongly recommend that you seek professional advice from your financial advisor or stockbroker before making any investment decision based on any of our recommendations. All the information we share represents our views on the date of publishing as stocks are subject to real time changes and therefore may change without notice. Please remember that investments can go up and down and past performance is not necessarily indicative of future returns. We request our readers not to interpret our reports as direct recommendations. To the extent permitted by law, Veye Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss, or data corruption) (as mentioned on the website www.veye.com.au), and confirms that the employees and/or associates of Veye Pty Ltd do not hold positions in any of the financial products covered on the website on the date of publishing this report. Veye Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services.