About 13.4% of Australia's GDP comes from the mining industry. Standing as the leading producer of mined commodities worldwide, Australia's mining sector contributes roughly 75% of the nation's exports and has long been a key component of the Australian economy.

With many more areas still to be investigated, Australia has already explored first-rate mineral deposits in WA, SA, and Queensland. Around 80% of Australia has not yet been explored, making it one of the largest unexplored mineral markets in the world, according to recent research.

The heightened need for battery minerals and other technological developments in this area to combat climate change are the primary drivers of the industry's notable volume growth.

The need for precious metals like nickel, platinum, and palladium, as well as copper and aluminium, which are utilized in electric vehicles, has increased overall. For the upcoming year and possibly beyond, electrification will be the primary factor driving volume. Most copper mines are now nearing the end of their lives, but some are still in the planning stages. Several new mines are already operational. As a result, there is a lot of room for technological advancement that can lower operating costs and improve the mine's overall operational efficiency. Older mines that are accruing higher operating costs require some innovation.

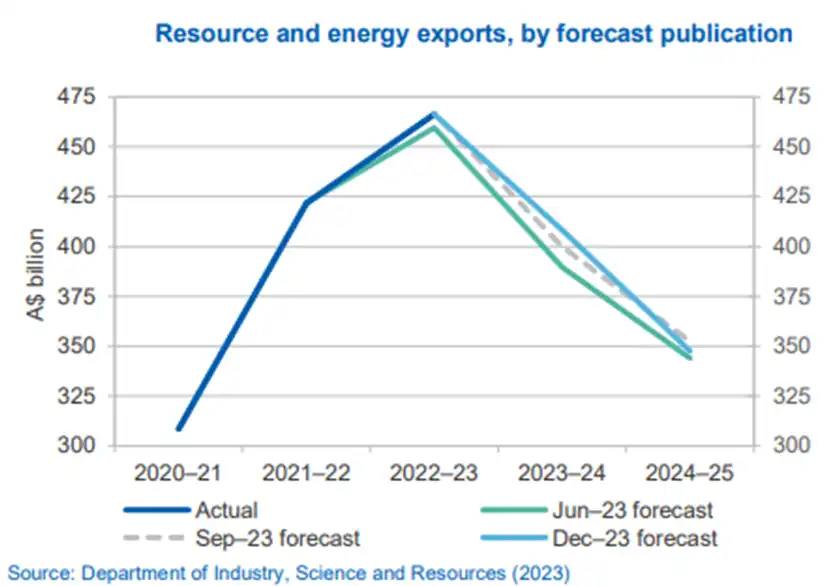

The impact of a stronger forecast exchange rate is expected to drive Australia's resources and energy exports, which are expected to total $5 billion in nominal prices in 2024–2025. (Source: Australian, Department of Industry, Science and Resources update.)

Let’s take a look at some of the top 5 ASX ‘basic material stocks’ for 2024 in different sizes based on their market capitalization. These are as follows:

Note: The market cap and the share price of the selected ASX companies mentioned are based on 25 January 2024.

Sandfire Resources Limited (ASX: SFR)

Market cap: $3.16 billion

CMP: $6.925

• In pursuit of a high-grade extension of the Johnny Lee deposit at Black Butte, the company persisted in its research. Drilling for a maiden resource at A1 is expected to begin in Q3 of FY2024, which is another prospect that will help boost copper production.

• Sandfire Resources Limited has been fundamentally strong, as the balance sheet contains cash and cash equivalents of $113 million. The Q1 FY2024 outcome of underlying group EBITDA reported at $66 million is a clear indication of strong operational activity to continue even further.

• By providing safe, dependable, and consistent performance and further lowering carbon intensity, the company is in a very strong position to generate significant value for shareholders. The company has shown courage in advocating for exploration potential by significantly increasing reserves in the provinces.

Iluka Resources Limited (ASX: ILU)

Market cap: $3.09 billion

CMP: $7.245

Iluka Resources is undergoing significant operational changes, including a four-month production pause at SR1 and SR2 starting in October 2023. They are set to resume operations in January 2024. The company has secured a steady revenue stream through 'take or pay' agreements for synthetic rutile production. Iluka is also exploring the rare earth market with a study to assess the feasibility of a rare earth metallization facility. Additionally, progress is being made on the Balranald project, with key contracts secured for its development. These initiatives reflect Iluka's commitment to diversification and growth in the mineral industry.

Deterra Royalties Limited (ASX: DRR)

Market cap: $2.83 billion

CMP: $5.36

• The significant expansion of the annual production capacity at Mining Area C on a substantial scale encourages a potential increase in the inflow of capital through payments for the company. Notably, almost all royalty payments for the company are from Mining Area C, which places heavy reliance on the same for revenue generation.

• Deterra receives an ongoing royalty of 1.232% of Australian dollar-denominated quarterly FOB (Free on Board) revenue from the MAC royalty area. Additionally, one-off capacity payments of A$1 million per one million dry metric tonnes (Mdmt) increase in annual mine production.

Coronado Global Resources Inc. (ASX: CRN)

Market cap: $2.74 billion

CMP: $1.635

CRN appears well-positioned in the current metallurgical coal market, marked by robust demand and limited supply. The company's commitment to ongoing operations and the development of enduring assets aligns with the expected scarcity of supply, likely driving sustained higher prices in the market.

CRN's high-quality metallurgical coal continues to be in significant demand across various continents due to its distinctive geographical diversification. Foreseen increases in prices are anticipated to positively impact revenue in the upcoming December quarter. The company's strategic emphasis on developing the Curragh North Underground Met Coal Project aims to achieve a saleable production of 13.5 MMt per year by 2025.

Fortescue Limited (ASX: FMG)

Market cap: $89.04 billion

CMP: $28.92

• When it runs on renewable energy by 2030, Fortescue's Iron Bridge project hopes to be Australia's biggest magnetite project. By FY25, 25% of fixed energy requirements will be met by solar energy thanks to the Pilbara Energy Connect project. Additionally, Belinga Hematite Project in Gabon is being advanced by Fortescue.

• Fortescue persisted in its dedication to decarbonizing the steel production process and working with partners like China Baowu Steel Group Corporation, the biggest steelmaker in the world, to reduce emissions. The business is also strategically putting itself in the critical minerals sector, realizing that demand for the minerals required for green technologies is only going to rise.

Reference: *All Data has been sourced from Company announcements and Refinitiv, Thomson Reuters

Frequently Asked Questions (F.A.Q)

Which are the top five basic materials stocks on the ASX?

• Sandfire Resources Limited (ASX: SFR)

• Iluka Resources Limited (ASX: ILU)

• Deterra Royalties Limited (ASX: DRR)

• Coronado Global Resources Inc. (ASX: CRN)

• Sims Limited (ASX: SGM)

What are Sims Limited's financial results for FY2023?

The revenues saw a $8.08 billion in 2023. The net profits declined 69.7% from $599.3 million in 2022 to $181.1 million in 2023. The EPS also declined from 303.1 cents to 93.7 cents between the respective periods. The company reported Total Liabilities worth $2.04 billion and Total Assets worth $4.70 billion as of 30 June 2023, leading to a Debt-to-asset ratio of 0.43. The current ratio stood at 1.79 for the same period. The cash inflows from operations declined 17.9% from $547.8 million in 2022 to $449.2 billion in 2023. The company reported full year dividends of 35.0 cents for the year, down from 91.0 cents last year.

Is it wise to invest in mining shares?

Mining shares is a wise investment because it gives investors exposure to commodity prices and an inflation hedge. Many investors buy mining stocks, which can also include gold stocks, as a means of guarding against inflation.

Veye Pty Ltd(ABN 58 623 120 865), holds (AFSL No. 523157 ). All information provided by Veye Pty Ltd through its website, reports, and newsletters is general financial product advice only and should not be considered a personal recommendation to buy or sell any asset or security. Before acting on the advice, you should consider whether it’s appropriate to you, in light of your objectives, financial situation, or needs. You should look at the Product Disclosure Statement or other offer document associated with the security or product before making a decision on acquiring the security or product. You can refer to our Terms & Conditions and Financial Services Guide for more information. Any recommendation contained herein may not be suitable for all investors as it does not take into account your personal financial needs or investment objectives. Although Veye takes the utmost care to ensure accuracy of the content and that the information is gathered and processed from reliable resources, we strongly recommend that you seek professional advice from your financial advisor or stockbroker before making any investment decision based on any of our recommendations. All the information we share represents our views on the date of publishing as stocks are subject to real time changes and therefore may change without notice. Please remember that investments can go up and down and past performance is not necessarily indicative of future returns. We request our readers not to interpret our reports as direct recommendations. To the extent permitted by law, Veye Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss, or data corruption) (as mentioned on the website www.veye.com.au), and confirms that the employees and/or associates of Veye Pty Ltd do not hold positions in any of the financial products covered on the website on the date of publishing this report. Veye Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services.