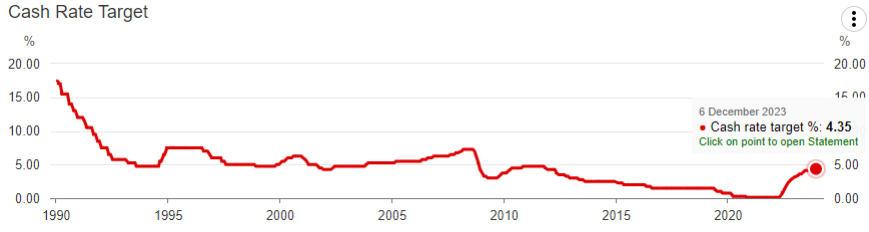

Monetary Policy is designed and carried out by the Reserve Bank of Australia. The money market's overnight lending rates are determined by monetary policy decisions. This interest rate has varying effects on other interest rates in the economy, which means that monetary policy affects how lenders and borrowers behave in the financial markets.

The Reserve Bank Board is primarily in charge of setting monetary policy. The Board meets, on average, eleven times a year on the first Tuesday of each month, with the exception of January. As a result, everyone knows well in advance when the meetings will take place. For every meeting, bank staff prepares a comprehensive report on the status of the Australian and global economies, as well as the local and international financial markets.

Source: Reserve Bank of Australia.

The interplay between supply and demand for overnight funds determines the cash rate in the money market. Because it controls the money supply that banks use to settle disputes among themselves, the Reserve Bank is able to effectively pursue a target for the cash rate. After the Reserve Bank accounts where the banks storing these funds are located, these are known as exchange settlement funds.

Source: Reserve Bank of Australia.

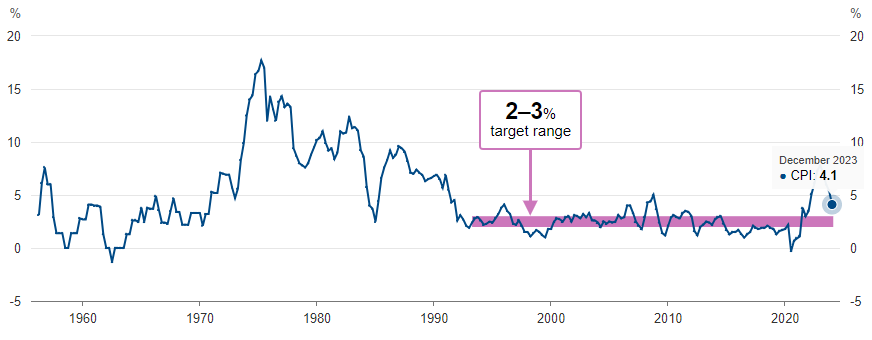

The Governor and the Treasurer have decided that a 2-3% inflation rate is the proper goal for monetary policy. This inflation rate is low enough not to significantly skew the community's economic choices. On average, aiming for this rate serves as a stabilizing force for private sector inflation expectations and disciplined decision-making regarding monetary policy.

The December quarter saw a further decline in inflation. Even with this improvement, the rate of inflation stays high at 4.1%. The RBA's November forecasts for goods price inflation were not met. It has eased further, indicating that the previous global supply chain disruptions have been resolved and that domestic demand for goods has moderated. However, the rate of decline in service price inflation was more gradual, staying high and consistent with the RBA's earlier forecasts.

The Australian Economy is Heading in the Direction of Greater Equilibrium.

The goal of Monetary Policy Decisions is to impede demand growth. People have reduced their spending due to high inflation, rising interest rates, and tax obligations. The labour market is becoming less tight in comparison to full employment. According to the overall analysis, demand has remained higher than the economy's ability to supply goods and services, which is driving up inflation.

Frequently Asked Questions (F.A.Q)

The study revealed that while Australia's monetary policy framework has yielded favorable economic outcomes over the past three decades, there are still several aspects that require improvement.

Who sets the Monetary Policy in Australia?

Monetary policy is created and carried out by the Reserve Bank of Australia (RBA). The target "cash rate," or market interest rate on overnight funds, is determined by the central bank.

Will Monetary Policy have an impact on GDP Expansion?

Monetary policy affects interest rates in the economy, including savings account interest rates, business loan interest rates, and housing loan interest rates. Interest rate changes have an impact on people's decisions to continue or invest, which ultimately has an impact on economic growth.

Veye Pty Ltd(ABN 58 623 120 865), holds (AFSL No. 523157 ). All information provided by Veye Pty Ltd through its website, reports, and newsletters is general financial product advice only and should not be considered a personal recommendation to buy or sell any asset or security. Before acting on the advice, you should consider whether it’s appropriate to you, in light of your objectives, financial situation, or needs. You should look at the Product Disclosure Statement or other offer document associated with the security or product before making a decision on acquiring the security or product. You can refer to our Terms & Conditions and Financial Services Guide for more information. Any recommendation contained herein may not be suitable for all investors as it does not take into account your personal financial needs or investment objectives. Although Veye takes the utmost care to ensure accuracy of the content and that the information is gathered and processed from reliable resources, we strongly recommend that you seek professional advice from your financial advisor or stockbroker before making any investment decision based on any of our recommendations. All the information we share represents our views on the date of publishing as stocks are subject to real time changes and therefore may change without notice. Please remember that investments can go up and down and past performance is not necessarily indicative of future returns. We request our readers not to interpret our reports as direct recommendations. To the extent permitted by law, Veye Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss, or data corruption) (as mentioned on the website www.veye.com.au), and confirms that the employees and/or associates of Veye Pty Ltd do not hold positions in any of the financial products covered on the website on the date of publishing this report. Veye Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services.