'Be Fearful When Others Are Greedy and Greedy When Others Are Fearful' – Warren Buffet.

The above quote of the investing legend Warren Buffet has provided right time and again. Historically, it has been seen that the best time to buy long-term equities is when the bearishness among investors is at its extreme. Triggered by a barrage of negative factors, the world equity market has been going through a difficult phase for the last six months- from high inflation and higher interest rates to a prolonged war. However, there are visible signs of the market bottoming out as the bearishness seems to have reached on highest level.

A bear market tends to make turnaround when the market has priced in all the negative triggers. Evidently, the market has accepted an inflationary environment along with rising rates. It has been apparent to investors that high inflation is not necessarily bad for the bottom lines of firms as they can increase prices to offset higher input costs. Moreover, the prospect of recession has been snubbed by positive data from the US jobs market. Clearly, investors seem to be unperturbed by the prospect of a prolonged war. Given this situation, we can find several factors that point towards a market turnaround:

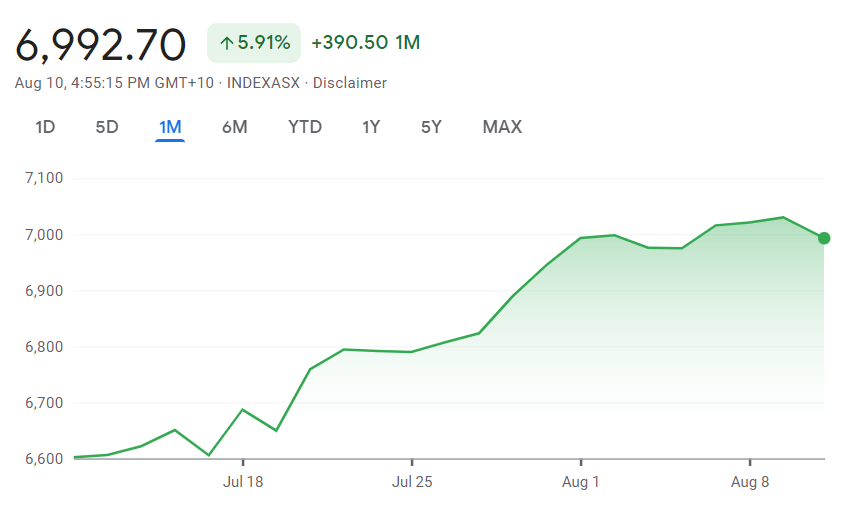

ASX is on a rise from last 1 month

We can see that the ASX is on a rise from last 1 month which denotes we are entering the environment which is opposite to market moving in a bearish mode. There is a 5.91% jump in S&P/ASX 200 over the last 30 days period.

(Reference – Google Finance)

Second quarter results are better than expected

Negative consumer sentiments, higher interest costs, fear of recessions, etc. led to an expectation of muted corporate results. However, the corporate results so far are better than expected by the general market consensus. A better-than-expected results by Netflix helped in lifting the mood of NASDAQ, which has been badly sold off in the last several months. Overall, the financial performance of firms in the second quarter has beaten market expectations.

Another interesting observation is that even though many firms have lowered their earnings forecast for the remaining half of the year, stocks have not responded negatively. This shows that investors’ uncertainty regarding firms’ performance has lowered and investors know what to expect. Also, since firms have set the earnings target lower; there is even a greater chance of beating expectations.

History is our best guide

Even though history does not repeat itself in the same way; there are often similarities. Looking at the following empirical observations, we can be optimistic about a market turnaround:

- According to Sam Stovall, chief investment strategist for CFRA Research, “The good news is that the bull market took just 161 calendar days to go from its peak to a 20% decline threshold—compared to an average of 245 days in past bear markets,”

- Historical market performance since 1945 shows that a rapid descent into the bear market often led to subsequent shallow declines rather than ‘mega-meltdowns’ i.e. market decline by more than 40%

- The S&P 500 experienced five bear markets ( 1961, 1966, 1987, 1990 and 2020) in which the indices fell the bear market threshold of 20% in a below-average time. The average market decline in all these five bear markets was less than 27%

According to Ryan Detrick, chief market strategist for LPL Financial, “`If a full-blown crisis and recession such as in 2000-2002 and 2008-09 can be avoided, this bear market may bottom soon,”. He also added that “the current bear market may be closer to a bottom than many expect,” and “how this bear market will end will likely hinge on the pace at which inflation comes down, which will dictate the timing and magnitude of the Federal Reserve’s rate hiking campaign.”

Some other indicators pointing towards market rebound

The ASX 200 has actually rebounded around 5% from the low of June.

Following are some other market facts that indicate a market turnaround:

1. There is a huge consensus that the US economy would enter a recession. Such an extreme negativity is often followed by a market turnaround.

2. Short-positions on small-cap stocks is at an extremely high level, indicating there is hardly any scope for the market to go any lower

3. A large number of hedge funds have shorted the general market

4. Both the NASDAQ and the S&P 500 have broken above their 50 days moving average

5. Relatively low number of stocks are trading above the 200 days moving average

These indicators are mostly showing extreme values, suggesting that the market has probably bottomed out. According to Veye director Varun Ratra “never give up in bear markets” because the “biggest gains are made in the early stages of the new uptrend,” Therefore, “The smartest opportunities appear in the young bull markets.”

What do we expect moving forward?

Factors like geo political tensions and rising interest rates appear to have already been discounted. The accumulation is already on, at the moment in certain select sectors, like bio, and tech.

The positive sentiments in the market denote that a market turnaround may not be far away.

Veye Pty Ltd(ABN 58 623 120 865), holds (AFSL No. 523157 ). All information provided by Veye Pty Ltd through its website, reports, and newsletters is general financial product advice only and should not be considered a personal recommendation to buy or sell any asset or security. Before acting on the advice, you should consider whether it’s appropriate to you, in light of your objectives, financial situation, or needs. You should look at the Product Disclosure Statement or other offer document associated with the security or product before making a decision on acquiring the security or product. You can refer to our Terms & Conditions and Financial Services Guide for more information. Any recommendation contained herein may not be suitable for all investors as it does not take into account your personal financial needs or investment objectives. Although Veye takes the utmost care to ensure accuracy of the content and that the information is gathered and processed from reliable resources, we strongly recommend that you seek professional advice from your financial advisor or stockbroker before making any investment decision based on any of our recommendations. All the information we share represents our views on the date of publishing as stocks are subject to real time changes and therefore may change without notice. Please remember that investments can go up and down and past performance is not necessarily indicative of future returns. We request our readers not to interpret our reports as direct recommendations. To the extent permitted by law, Veye Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss, or data corruption) (as mentioned on the website www.veye.com.au), and confirms that the employees and/or associates of Veye Pty Ltd do not hold positions in any of the financial products covered on the website on the date of publishing this report. Veye Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services.