Ahead of a planned digital minerals auction on the Battery Material Exchange (BMX), Pilbara Minerals has accepted a pre-auction offer for a cargo of lithium spodumene concentrate. A group of registered BMX participants was offered the opportunity to purchase a shipment of 5,000 dry metric tonnes before a potential BMX auction was held. A pre-auction offer of US$1,106/dmt on a SC5.5 CIF China basis was accepted by the company out of several that it had received. A sales contract was then signed with the buyer. After accounting for lithia content and freight charges, this offer works out to be roughly $1,200/dmt on a SC6.0 CIF China basis. The shipment is scheduled for the December 2024 quarter due to the Company's current offtake commitments.

Mining Company Pilbara has declared the signing of a new offtake contract with Sichuan Yahua for the supply of concentrate made of spodumene from the company's fully owned Pilgangoora operating unit.

Pilbara Minerals’ Managing Director and CEO, Dale Henderson, said: This offtake strengthens the already strong relationship that exists between our companies, as we have successfully completed several sales together in the past. With this agreement, Yahua is able to further deepen its supply chain commitments with major international battery customers and enhance Pilbara Minerals' medium-term sales profile while maintaining long-term flexibility as we evaluate downstream opportunities in accordance with our growth strategy.

Pilbara Minerals Limited’s strategic priorities:

Production expansions for the P680 and P1000 projects are PLS's top strategic priorities. By boosting production capacity and bringing about scale benefits like lower unit costs, this will increase the operation's profitability. The entire funding for the P680 and P1000 projects comes from cash reserves that are currently on hand. Furthermore, with the beginning of Train 1's commissioning at POSCO Pilbara Minerals' joint venture chemical plant in South Korea, PLS’s long-standing goal to take part in the manufacturing of lithium chemicals was further advanced. Along with Calix, a joint venture partner, a final investment decision (FID) was also made to build the Mid-Stream Demonstration Plant Project.

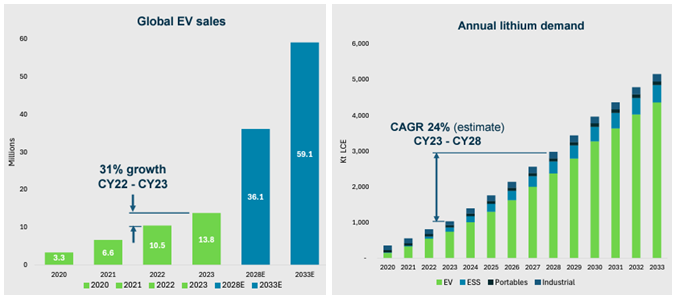

Projection of Annual lithium demand:

(Graphic Source – Company Reports)

Up until CY 2028, the annual lithium demand is predicted to increase at a compound annual growth rate of 24%. Since the production of EVs and other energy storage applications is growing at a compound annual rate, the long-term prospects for lithium remain positive. However, as with many developing sectors, the industry has seen lithium price volatility, including periods when prices were lower. Due to its low unit-cost structure and strong balance sheet position, PLS is in a unique position compared to many of its competitors in the lithium sector to withstand and benefit from a period of lower prices that could rationalize the market. With its continuous production and better market conditions, PLS will be particularly well-positioned to benefit when the pricing cycle turns.

Reference: *All Data has been sourced from Company announcements and Refinitiv, Thomson Reuters

Veye Pty Ltd(ABN 58 623 120 865), holds (AFSL No. 523157 ). All information provided by Veye Pty Ltd through its website, reports, and newsletters is general financial product advice only and should not be considered a personal recommendation to buy or sell any asset or security. Before acting on the advice, you should consider whether it’s appropriate to you, in light of your objectives, financial situation, or needs. You should look at the Product Disclosure Statement or other offer document associated with the security or product before making a decision on acquiring the security or product. You can refer to our Terms & Conditions and Financial Services Guide for more information. Any recommendation contained herein may not be suitable for all investors as it does not take into account your personal financial needs or investment objectives. Although Veye takes the utmost care to ensure accuracy of the content and that the information is gathered and processed from reliable resources, we strongly recommend that you seek professional advice from your financial advisor or stockbroker before making any investment decision based on any of our recommendations. All the information we share represents our views on the date of publishing as stocks are subject to real time changes and therefore may change without notice. Please remember that investments can go up and down and past performance is not necessarily indicative of future returns. We request our readers not to interpret our reports as direct recommendations. To the extent permitted by law, Veye Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss, or data corruption) (as mentioned on the website www.veye.com.au), and confirms that the employees and/or associates of Veye Pty Ltd do not hold positions in any of the financial products covered on the website on the date of publishing this report. Veye Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services.