(Graphic Source – Yahoo Finance)

Fig.: 5 year performance of ASX 200

The ASX 200 has been performing steadily over the past five years, with a compound annual growth rate of roughly 4.62%. The ASX 200 showed considerable growth from 30/10/2023 to 5/3/2024, as demonstrated by the absolute return of about 14.26%, which indicates that the Australian markets are experiencing a robust upswing.

Investors are clearly excited about the recent strong performance of the ASX 200 index and are looking forward to more gains in the coming days. Although the joy of making money in the market is evident and palpable, it is important to approach this optimism with caution.

No one knows to what extent the stocks will continue to maintain the upswing despite having a higher valuation. In general, a common habit of people is to bargain while buying goods and services from the market; similarly, in the case of stocks, value investors prefer investing during a recession as they get an opportunity to buy stocks at the most reasonable price.

The positive announcements regarding the Australian economy included improved GDP growth, which increased by 0.2% in the September quarter on previous quarter, on account of a higher government consumption and capital investment. This could increase market sentiment and boost investor confidence. Stock prices have risen and valuations have been sustained by the numerous companies that have shown phenomenal growth in earnings. In the midst of this excitement brought on by an economy that keeps bucking macroeconomic forces and demonstrating resiliency, many investors are growing uneasy and debating whether to stop investing or put it off.

It is possible that stopping or postponing investments will not result in any benefits. Even those who describe themselves as long-term investors are rushing to secure profits from market investments, demonstrating that giving in to market hype has proven more harmful than helpful. It is almost impossible, even for seasoned professionals, to predict market movements with consistency.

The stock market often reaches all-time highs, but this does not always mean that a correction is about to happen. In actuality, historical data shows that markets can rise for extended periods of time even after hitting all-time highs.

S&P/ASX200 return performance:

Source: Yahoo Finance

Fig.: S&P/ASX 200 performance over two decades

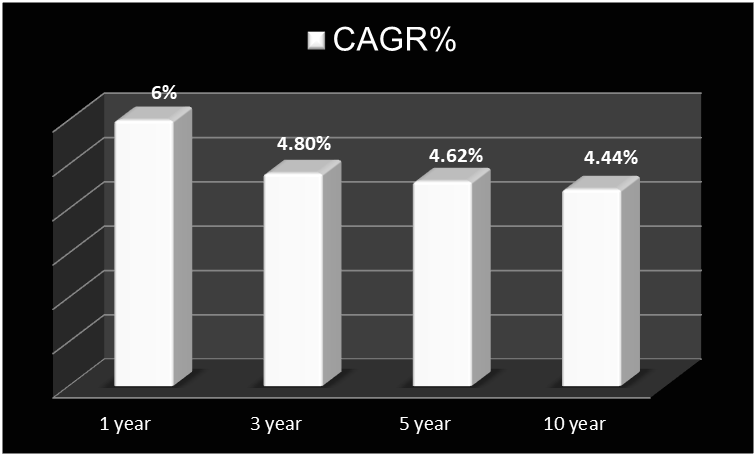

Fig.: Annualized return delivered by S&P/ASX 200 in different tenures.

Source: Veye Pty Ltd.

The S&P/ASX 200's annualized return during a differential period is evidence of the advantages of long-term investing. It is evident from the above graph that investing requires time, as opposed to timing the market. It might be nearly impossible to generate a sizable return without patience and the willingness to take risks.

Since 2000, the markets have experienced a variety of ups and downs. A substantial amount of money was lost by tech boom investors at the time of the market's severe collapse. However, the market's game did not end there. Once more, it had stood and fought fiercely along the path. Subprime mortgage crises later in 2008 snatched maximum market capitalization once more. The investor's portfolio had suffered significant damage. Nonetheless, there are legendary investors who held onto their money because they thought the market would rise once more and seized the chance to purchase stock at an enticing price. "Discounted price" is the term used in investing.

2020 saw a sharp decline in ASX Share Prices due to the Covid-19 pandemic, but later on, global markets made a strong comeback and gave prospective investors multiple times their investment back. Thus, the contrarian who favors value investing regardless of the state of the market—whether it is at an all-time high or in a bear phase. ‘Purchasing gold at the price of silver’ is only feasible during the carnage, as favorable circumstances and favorable timing are incompatible.

Veye Pty Ltd(ABN 58 623 120 865), holds (AFSL No. 523157 ). All information provided by Veye Pty Ltd through its website, reports, and newsletters is general financial product advice only and should not be considered a personal recommendation to buy or sell any asset or security. Before acting on the advice, you should consider whether it’s appropriate to you, in light of your objectives, financial situation, or needs. You should look at the Product Disclosure Statement or other offer document associated with the security or product before making a decision on acquiring the security or product. You can refer to our Terms & Conditions and Financial Services Guide for more information. Any recommendation contained herein may not be suitable for all investors as it does not take into account your personal financial needs or investment objectives. Although Veye takes the utmost care to ensure accuracy of the content and that the information is gathered and processed from reliable resources, we strongly recommend that you seek professional advice from your financial advisor or stockbroker before making any investment decision based on any of our recommendations. All the information we share represents our views on the date of publishing as stocks are subject to real time changes and therefore may change without notice. Please remember that investments can go up and down and past performance is not necessarily indicative of future returns. We request our readers not to interpret our reports as direct recommendations. To the extent permitted by law, Veye Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss, or data corruption) (as mentioned on the website www.veye.com.au), and confirms that the employees and/or associates of Veye Pty Ltd do not hold positions in any of the financial products covered on the website on the date of publishing this report. Veye Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services.