Green Bonds Australia

Green bonds are basically issued to provide financial support for specific projects that are particularly beneficial to the environment. The standardized definitions for green bonds are still in a developmental phase. Therefore, classifications may vary amongst issuers depending on individual sustainability frameworks. Investors and issuers have tended to assess a green bond’s credibility based on voluntary guidelines developed by international non-profit organizations. The International Capital Market Association’s ‘green bond principles’ are built broadly on four main criteria, such as:

• The funds raised through green bond issuance should have a clear pathway for environmental benefits.

• The issuer should disclose the project evaluation and selection process.

• The issuer should provide a transparent and visible way for investors to track the allocation of funds, including how the funds are being used on the project.

• The issuer should publish annual reports and highlight all the relevant aspects of the issuance purpose.

The main purpose of the green bond principle is to take control of "greenwashing," which means misrepresenting the bonds as greener than they really are.

The Australian green bond market size is comparably smaller than the total fixed-income issuance. As per the Australian government report, approximately $13 billion of green bonds were issued in the first half of 2023.

Australian green bonds are issued by the following:

• Australian state treasury corporations

• Major Australian banks

• ‘Kangaroo issuers’ are non-resident organizations that issue bonds denominated in Australian dollars.

The share of green bonds issued in the domestic market has been high and largely driven by issuance by state treasury corporations and kangaroo issuers. The green bonds are primarily issued by financial corporations in offshore markets. The Australian government has a plan to launch sovereign green bond issuance in the middle of 2024.

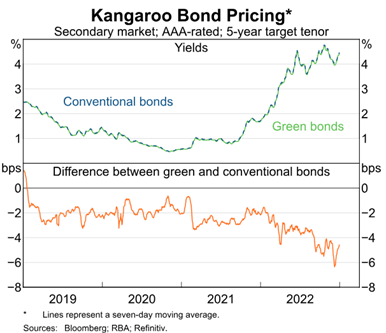

It has been observed in the international markets that green bonds can attract investors at lower yields than their non-green bonds, which indicates that the investors are willing to pay a higher price for green securities, a so-called ‘Greenium’. A comparable study has been conducted in the secondary market for green and non-green bonds issued by AAA-rated kangaroo issuers. The data outcome concluded that there was some evidence of a small Greenium for AAA-rated kangaroo bonds.

The green bond markets are less liquid compared to their conventional counterparts, which implies that their tradability is lower on secondary markets.

(Graphic Source – Company Reports)

Frequently Asked Questions (F.A.Q)

What is green bond in Australia?

Bonds are basically debt instruments. When the word green implies a bond, it defines a special category of bonds that an institution issues for the purpose of financing projects that contribute positively towards environmental development.

What are the disadvantages of green bonds?

The credibility of the issuer of this kind of bond is a question mark. The issuer of the bond uses the proceeds to finance projects that might harm the environment. There is a lack of ratings and rating guidelines.

Who is the issuer of a green bond?

Australian green bonds are issued by the following:

• Australian state treasury corporations.

• Major Australian banks.

• ‘Kangaroo issuers’ are non-resident organizations that issue bonds denominated in Australian dollars.

What is the difference between green bond and conventional bond?

There is a marginal difference between the green bond and the conventional bond. Green bond proceeds are used for environmental purposes, whereas non-green bond proceeds are not.

Veye Pty Ltd(ABN 58 623 120 865), holds (AFSL No. 523157 ). All information provided by Veye Pty Ltd through its website, reports, and newsletters is general financial product advice only and should not be considered a personal recommendation to buy or sell any asset or security. Before acting on the advice, you should consider whether it’s appropriate to you, in light of your objectives, financial situation, or needs. You should look at the Product Disclosure Statement or other offer document associated with the security or product before making a decision on acquiring the security or product. You can refer to our Terms & Conditions and Financial Services Guide for more information. Any recommendation contained herein may not be suitable for all investors as it does not take into account your personal financial needs or investment objectives. Although Veye takes the utmost care to ensure accuracy of the content and that the information is gathered and processed from reliable resources, we strongly recommend that you seek professional advice from your financial advisor or stockbroker before making any investment decision based on any of our recommendations. All the information we share represents our views on the date of publishing as stocks are subject to real time changes and therefore may change without notice. Please remember that investments can go up and down and past performance is not necessarily indicative of future returns. We request our readers not to interpret our reports as direct recommendations. To the extent permitted by law, Veye Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss, or data corruption) (as mentioned on the website www.veye.com.au), and confirms that the employees and/or associates of Veye Pty Ltd do not hold positions in any of the financial products covered on the website on the date of publishing this report. Veye Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services.