Within the earth's natural resources, gold is considered one of the most valuable metals due to its uncommon availability and unique physical characteristics.

By 2025, it is anticipated that global gold consumption will have stabilized below recent high levels, coming in at 4,450 tonnes. Rising jewelry consumption and a rebound in the market for high-tech manufacturing are predicted to be the main drivers of demand growth during this time. The consumption of jewellery is expected to increase significantly starting in 2024 and reach 2,350 tonnes by 2025.

Global gold supply is forecast to stabilize above 4,800 tonnes in the period to 2025, with increasing world gold mine production offset by decreasing supply from recycling activity. World gold mine production is forecast to rise by 1.4% a year on average by 2025 to 3,780 tonnes, led by gains in Canada, the US, Chile, and Brazil.

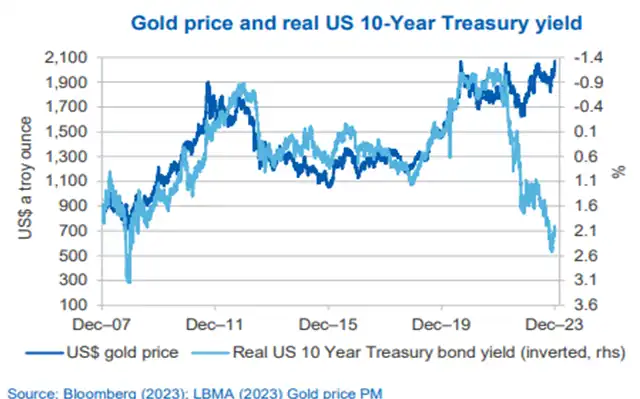

The allure of gold as a safe asset to protect against inflation or other risks tends to decline for institutional and retail investors as bond yields rise. This is due to the fact that rising yields on US Treasury bonds, or other reliable government bonds, raise the market's "risk-free rate," which in turn raises the opportunity cost of owning gold and drives down the bond prices. But after Russia invaded Ukraine, the correlation between real bond yields and gold prices fell precipitously, with prices rising due to increased demand for the metal as a safe haven. Since then, this has continued to be a factor, mitigating the impact of growing interest rates. (Reference: - Australian Government, Department of Industry Science and Resources, Resources and Energy Quarterly December 2023.)

Let’s take a look at some of the highly specialized ASX gold mining companies for 2024 in different sizes based on their market capitalization. These are as follows:

Note: The market cap and the share price of the selected ASX companies below are mentioned as of 22 January 2024.

Besra Gold Inc. (ASX: BEZ)

Market cap: $1.75 billion

CMP: $1.595

The successful production of gold concentrate at BEZ's Bau Gold Project demonstrates the company's commitment to fulfilling contractual obligations, validating operational processes, and achieving positive exploration results. The pleasing gold concentrate grades from Stage 1 bench-scale testing and the continuation of trial processing in Stage 2 position BEZ for potential future production contribute to enhanced shareholder and market confidence in the company's prospects.

ROX Resources Limited (ASX: RXL)

Market cap: $57.25 million

CMP: $0.155

• Rox’s recent test work and historic performance indicate simplified metallurgy. Historical production shows consistent concentrate production of >40 g/t gold in concentrate with ~2%. Recent test work confirms conventional flotation produces a high-grade, low-arsenic gold concentrate. With only partial Sulphur Oxidation of the concentrate (33%), gold leach extraction is 0–95%.

• The key purchasers of gold concentrates are generally in China, although some Australian and international-based roasters, pressure oxidation (POX), and bio-oxidation (BIOX) processors have capacity. With changed Chinese regulations, an increased demand has been created for low-arsenic gold concentrates. Youanmi gold concentrate will attract a premium due to the low As content and high gold content.

Northern Star Resources Limited (ASX: NST)

Market cap: $14.23 billion

CMP: $12.38

The company is well positioned to deliver 1,600–1,750 koz of gold, sold at an AISC of A$1,730–1,790/oz in FY2024. Due to higher production at Thunderbox, where the mill sustainably produces 6 Mtpa, higher ore volumes and grades at KCGM and ongoing grade improvement at Pogo, the weight of gold sold will be heavier towards 2H. The business also keeps its exploration budget of A$150 million (19% spent YTD) and growth capex budget guidance of A$1,150–1,250 million for FY2024.

De Grey Mining Limited (ASX: DEG)

Market cap: $2.19 billion

CMP: $1.185

De Grey Mining's outlook appears promising due to its robust drilling plans aimed at expanding gold resources at the Hemi project. The ongoing focus on extending known deposits and exploring potential targets in the Greater Hemi region reflects the company's commitment to resource expansion and value creation. The emphasis on conducting new pit shell optimizations based on updated resource estimates signifies a proactive approach to maximize open-pit production potential.

Genesis Minerals Limited (ASX: GMD)

Market cap: $1.76 billion

CMP: $1.598

The recent high-grade drill results below Gwalia's current stopping horizon signify a promising avenue for future resource expansion by Genesis Minerals. These findings stand as a testament to the company's operational efficiency, bolstered productivity, and growth potential post-acquisition. Additionally, the completion of the Bellevue Toll Treatment Agreement (TTA), with the final processing of ore conducted early in the current December quarter, marks a significant milestone in the company's operational progress with third-party processing obligations, including an Ore Purchase Agreement (OPA) with Linden and a Toll Treatment Agreement (TTA) with Brightstar Resources (ASX: BTR) remaining.

Reference: *All Data has been sourced from Company announcements and Refinitiv, Thomson Reuters

Frequently Asked Questions (F.A.Q)

What are the best ASX gold companies for 2024?

- Besra Gold Inc. (ASX: BEZ)

- ROX Resources Limited (ASX: RXL)

- Northern Star Resources Limited (ASX: NST)

- De Grey Mining Limited (ASX: DEG)

- Genesis Minerals Limited (ASX: GMD)

What are the fundamental developmental aspects of Northern Star Resources Limited?

After the company's board previously approved the final investment decision, the Fimiston processing plant will see an increase in milling capacity from 13 Mtpa to 27 Mtpa by FY2027. Throughput is expected to reach nameplate capacity starting in FY2029. The company's recent outperformance is indicative of the recognition of Northern Star's many attractive attributes, which include its high-quality assets that generate strong cash flows, realistic growth prospects, long mine lives, a strong balance sheet, competent operational and entrepreneurial management, and a highly skilled workforce.

What is the outlook for gold?

In the period up to 2025, the global gold supply is expected to stabilize above 4,800 tonnes, according to the resources and energy December quarter 2023 report. It is anticipated that starting in 2024, jewellery consumption is likely to rise dramatically to 2,350 tonnes by 2025. Up until 2025, the amount of gold in the world is expected to stabilize at or above 4,800 tonnes.

Veye Pty Ltd(ABN 58 623 120 865), holds (AFSL No. 523157 ). All information provided by Veye Pty Ltd through its website, reports, and newsletters is general financial product advice only and should not be considered a personal recommendation to buy or sell any asset or security. Before acting on the advice, you should consider whether it’s appropriate to you, in light of your objectives, financial situation, or needs. You should look at the Product Disclosure Statement or other offer document associated with the security or product before making a decision on acquiring the security or product. You can refer to our Terms & Conditions and Financial Services Guide for more information. Any recommendation contained herein may not be suitable for all investors as it does not take into account your personal financial needs or investment objectives. Although Veye takes the utmost care to ensure accuracy of the content and that the information is gathered and processed from reliable resources, we strongly recommend that you seek professional advice from your financial advisor or stockbroker before making any investment decision based on any of our recommendations. All the information we share represents our views on the date of publishing as stocks are subject to real time changes and therefore may change without notice. Please remember that investments can go up and down and past performance is not necessarily indicative of future returns. We request our readers not to interpret our reports as direct recommendations. To the extent permitted by law, Veye Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss, or data corruption) (as mentioned on the website www.veye.com.au), and confirms that the employees and/or associates of Veye Pty Ltd do not hold positions in any of the financial products covered on the website on the date of publishing this report. Veye Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services.