Cboe Australia (CXA Stock Exchange)

Cboe Australia (CXA) is a securities and derivatives exchange that provides a platform for investors as an alternative trading venue to the Australian Securities Exchange (ASX). It is an alternative platform that helps improve and grow Australian investment markets, providing investors with the most efficient and cost-effective access to local and global investment opportunities.

The alternative Australian exchange offers trading across a range of products, including warrants and funds, which are massively traded in significant volumes on the CXA exchange.

CXA also offers more than 800 uniquely quoted warrants across various ranges of asset classes that include equities, commodities, indices, currencies, and fixed income.

Cboe Australian Funds Market consists of exchange-traded funds (ETFs) and quoted managed funds (QMFs).

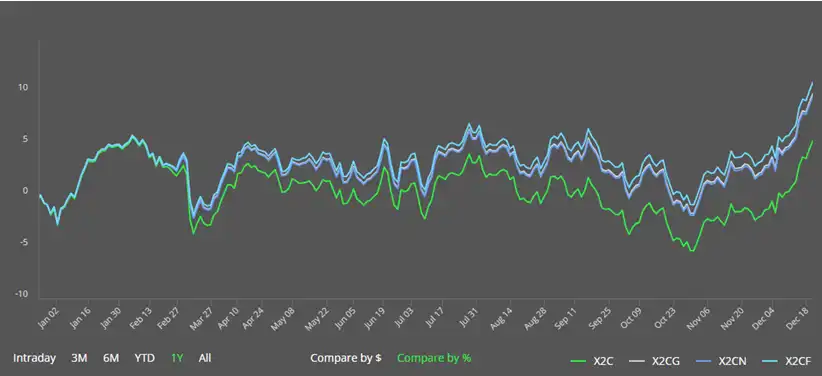

The Cboe Australian 200 Index (CXA 200 Index) is basically a free-float capitalization-weighted index with a weight of approximately 0.8 in the total Australian equity market.

Fig: CXA 200 Indices 1- year chart

Source: www.cboe.com/au/indices/

Chi-X Australia was the former name of Cboe Australia (CXA), a stock exchange based in Sydney, Australia. Earlier in June 2021, Cboe Global Markets, Inc., a leading provider of global market infrastructure and tradable products, acquired Chi-X Asia Pacific Holdings, Limited. Eventually, in early 2022, Chi-X Australia Pty Limited got a name change to Cboe Australia Pty Limited.

Frequently Asked Questions (F.A.Q)

What is the abbreviation for Cboe?

The abbreviation of Cboe is “Chicago Board Options Exchange." In early 2022, Chi-X Australia Pty Limited got a name change to Cboe Australia Pty Limited.

What is the Chi-X Australia (Cboe)?

Chi-X Australia was the former name of Cboe Australia (CXA), a stock exchange based in Sydney, Australia. Earlier in June 2021, Cboe Global Markets, Inc., a leading provider of global market infrastructure and tradable products, acquired Chi-X Asis Pacific Holdings, Limited. Eventually, in early 2022, Chi-X Australia Pty Limited got a name change to Cboe Australia Pty Limited.

What is CXA?

Cboe Australia (CXA) is a securities and derivatives exchange that provides a platform for investors as an alternative trading venue to the Australian Securities Exchange (ASX). It is an alternative platform that helps improve and grow Australian investment markets, providing investors with the most efficient and cost-effective access to local and global investment opportunities.

Veye Pty Ltd(ABN 58 623 120 865), holds (AFSL No. 523157 ). All information provided by Veye Pty Ltd through its website, reports, and newsletters is general financial product advice only and should not be considered a personal recommendation to buy or sell any asset or security. Before acting on the advice, you should consider whether it’s appropriate to you, in light of your objectives, financial situation, or needs. You should look at the Product Disclosure Statement or other offer document associated with the security or product before making a decision on acquiring the security or product. You can refer to our Terms & Conditions and Financial Services Guide for more information. Any recommendation contained herein may not be suitable for all investors as it does not take into account your personal financial needs or investment objectives. Although Veye takes the utmost care to ensure accuracy of the content and that the information is gathered and processed from reliable resources, we strongly recommend that you seek professional advice from your financial advisor or stockbroker before making any investment decision based on any of our recommendations. All the information we share represents our views on the date of publishing as stocks are subject to real time changes and therefore may change without notice. Please remember that investments can go up and down and past performance is not necessarily indicative of future returns. We request our readers not to interpret our reports as direct recommendations. To the extent permitted by law, Veye Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss, or data corruption) (as mentioned on the website www.veye.com.au), and confirms that the employees and/or associates of Veye Pty Ltd do not hold positions in any of the financial products covered on the website on the date of publishing this report. Veye Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services.