The bank maintains a solid foundation for strong customer relationships in the retail category. With 35% of all Australians naming CBA as their main financial institution, the prevailing strategy is centered on deepening and strengthening customer relationships through superior experiences and better personalization.

The Australian leading bank presented its Q12024 on November 14, 2022, with an increase in operational expenses of 3% on account of higher staff costs from wage inflation and higher amortization. The operating income was recorded on a flat note, which was primarily driven by higher volume growth. The company came up with its unaudited statutory net profit after tax (NPAT) number of $2.5 billion in the quarter. The unaudited cash NPAT of $2.5 billion was flat on the 2H2023 quarterly average and up 1% on the previous comparative quarter. The profit and loss statement recorded a loan impairment expense of $198 million, with collective and individual provisions slightly higher. The net interest income was up by 0.5% with solid volume growth. The company redeemed $19 billion from the Reserve Bank of Australia Term Funding Facility (TFF) during the quarter. It accounted for growth momentum in the business banking franchise and delivered strong outcomes in the quarter. The home loan arrears appeared to increase modestly by 0.49%. The TIA was reported to be lower at $6.8 billion, or 0.49% of TCE. The personal loan arrears were reduced during the quarter in line with seasonal trends.

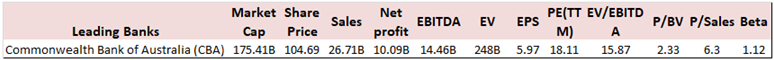

FY2023 Financial Metrics for the period ending 30 June 2023:

[Note]: Market cap and share price were taken as of 5 December 2023. The sales and net profit numbers are taken as of CBA: 30 June 2023.

[Note]: Market cap and share price were taken as of 5 December 2023. The sales and net profit numbers are taken as of CBA: 30 June 2023.

It is evident from the above demonstrative table that it presents financial metrics of enterprise value, and the respective EV/EBITDA multiple of 15.87x offers further room for growth as the only company dominating the banking space as well as having a significant position in the ASX 200 Index.

Fig: The above straight line graph shows a 5-year chart.

*All Data has been sourced from Company announcements and Refinitiv, Thomson Reuters

The 5-year compounded annual growth rate of Commonwealth Bank share price is approximately 8.61%, while the ASX 200 (ASX: XJO) has delivered a mere progress of CAGR of approximately 4.75%. The 5-year average beta stands at 1.12, which indicates the company has moderate risk and delivered better performance than the index.

Outlook and Fundamentals of CBA:

The Australian economy stood affirmed as benefiting from the significant tailwinds of a recovery in population growth, high commodity prices, and a low unemployment rate. However, the persisting risk of rising interest rates has a lagged impact on mortgage customers, and the cost of living pressures have become a financial strain for Australians. The company downplayed the rising interest rate regime and continued to remain healthy in its balance position with strong credit facilities and marginally lower home loan arrears. The ability to generate strong capital is a good indication for supporting customers. The company is well executing its strategy to build a brighter future down the line.

On a fundamental note, the balance sheet remains strong, with a common equity Tier-1 ratio of 12.2% as of June 30, 2023, well above the minimum regulatory requirement. The company successfully completed the $3 billion on-market share buyback during FY2023, which is a testament to the company’s effort to strengthen the balance sheet. It has maintained a strong provisional coverage of 1.65%, comparatively better than its peers. The bank’s liquidity coverage ratio and net stable funding ratio remained well above regulatory mandates. CBA’s Level 2 Tier 1 and Total Capital ratios as of September 30, 2023, were 14.1% and 19.7%, respectively, extraordinarily maintaining the capital requirement norms. The company is currently trading at a PE multiple of 17.49x, which implies a reasonable price.

Frequently Asked Questions (F.A.Q)

How big is the Commonwealth Bank?

The market capitalization of the leading bank is $175.41 billion as of 5 December 2023 and the enterprise value is $248 billion. It holds a notable position in the ASX 200.

Is Commonwealth Bank worldwide?

The CBA is an Australian multinational bank with businesses across New Zealand, Asia, the U.S., and the UK. It provides several financial services, including retail, business, and institutional banking; fund management; superannuation; insurance; investment; and broking services. The CBA is the largest ASX-listed company on the Australian Securities Exchange.

What is the ranking of the Commonwealth Bank of Australia?

Millions of Australians trust CBA with their savings. The company aims to be their trusted financial partner at a time when many are feeling the strain of higher interest rates and the rising cost of living. The CBA holds a sector rank of 1 of 586 and an ASX rank of 2 of 2,408.

What are the leading banks in Australia?

The ASX 200 Index, which contains top-leading banks such as Commonwealth Bank of Australia (CBA), Westpac Banking Corporation (WBC), ANZ Group Holdings Ltd. (ANZ), and National Australia Bank Ltd. (NAB), captures the majority of the pie.

Veye Pty Ltd(ABN 58 623 120 865), holds (AFSL No. 523157 ). All information provided by Veye Pty Ltd through its website, reports, and newsletters is general financial product advice only and should not be considered a personal recommendation to buy or sell any asset or security. Before acting on the advice, you should consider whether it’s appropriate to you, in light of your objectives, financial situation, or needs. You should look at the Product Disclosure Statement or other offer document associated with the security or product before making a decision on acquiring the security or product. You can refer to our Terms & Conditions and Financial Services Guide for more information. Any recommendation contained herein may not be suitable for all investors as it does not take into account your personal financial needs or investment objectives. Although Veye takes the utmost care to ensure accuracy of the content and that the information is gathered and processed from reliable resources, we strongly recommend that you seek professional advice from your financial advisor or stockbroker before making any investment decision based on any of our recommendations. All the information we share represents our views on the date of publishing as stocks are subject to real time changes and therefore may change without notice. Please remember that investments can go up and down and past performance is not necessarily indicative of future returns. We request our readers not to interpret our reports as direct recommendations. To the extent permitted by law, Veye Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss, or data corruption) (as mentioned on the website www.veye.com.au), and confirms that the employees and/or associates of Veye Pty Ltd do not hold positions in any of the financial products covered on the website on the date of publishing this report. Veye Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services.