In poker, you do not make big money when you get bad odds. You also do not make money when you get good odds but your opponent gets weak odds. You make big money when your odds are good and your opponent also holds good hand.

It is similar in Stock Market Investment. Once you hold a position, “Never catch a falling knife” can be best used in reversing the losses and maximizing profit from stocks.

Although investing in stocks with downward momentum for maximum profit is risky, it offers many profitable points and several ways to profit from the Falling Knife Strategy.

Since there could be many potential causes for a falling knife to happen, identifying these forms the backbone of the concept of profit maximization. This could reveal a potential buying opportunity. However, not all stocks offer such an opportunity as they continue to fall and even deny a favorable point to add on.

The strategy is not guaranteed and 100% foolproof as the stock price are driven by both temporary and longer lasting factors like Earnings and Economic reports and Fundamental deterioration.

The strategy was best implemented successfully in two stocks given below for reversing from a loss making position and to augment profits.

Santana Minerals Limited (ASX: SMI)

Santana Minerals Limited is an Australia-based metal deposit company having Bendigo-Ophir, Cuitaboca and Cambodia Projects. The first buy was initiated when it had announced further significant results from the 100% owned Bendigo-Ophir Project where a 643Koz Inferred Gold Resource (MRE) in four Rise and Shine Shear Zone (RSSZ) Deposits had been estimated to JORC Code 2012.

The stock had come down but remained range bound and after aggressive drilling and assays from the same consistently yielded positive results and significant intersections across the calendar year, another buy was initiated at much lower price.

Ongoing exploration success rapidly adding gold ounces and increasing grade and improvement in head grade and Resource expansion executed at a low cost of $3.50 per ounce pushed the price higher. When this was discounted, recommended sell at a profit of 48.19%.

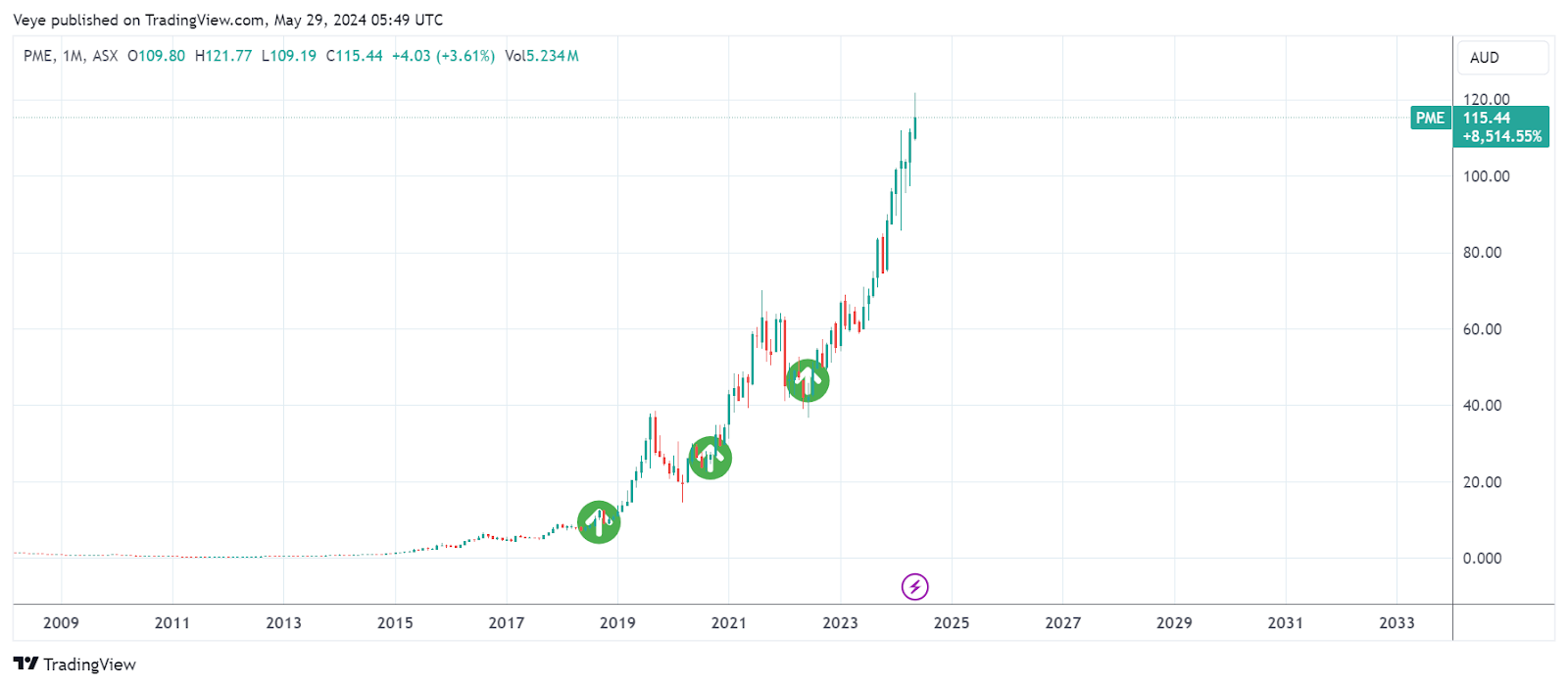

Pro Medicus Limited (ASX: PME)

Pro Medicus Limited (ASX: PME), a market leader in health imaging, reported a half-year net profit of $36.3 million for the six months ending in December 2023 on 15 February 2024. This represented a 33.3% increase over the previous corresponding period. Over a six-month period, the revenue from customer contracts increased by 30.3%, from $56.89 million to $74.11 million.

Following a comparable period of $37.22 million, the underlying profit before tax increased by 31.5% to $48.93 million.

Across all market segments, the PME pipeline is robust. It is anticipated that the growing number of clients opting for the full suite of Visage products—Viewer, Workflow, and Archive—demonstrates how the cloud-based modular approach continues to offer unmatched flexibility and scalability. The company successfully completed four new implementations, all of which will generate a full six months of revenue in the second half, and benefited from above-industry growth in exam volumes across the client base. Furthermore, the year's best sales start will provide extra impetus for a stronger second half than the first, laying the groundwork for future growth in FY2025 and beyond.

In this stock, every time a new rally started, buy was initiated to enhance profits. Until now, the average profit has increased to more than 395%.

Veye Pty Ltd(ABN 58 623 120 865), holds (AFSL No. 523157 ). All information provided by Veye Pty Ltd through its website, reports, and newsletters is general financial product advice only and should not be considered a personal recommendation to buy or sell any asset or security. Before acting on the advice, you should consider whether it’s appropriate to you, in light of your objectives, financial situation, or needs. You should look at the Product Disclosure Statement or other offer document associated with the security or product before making a decision on acquiring the security or product. You can refer to our Terms & Conditions and Financial Services Guide for more information. Any recommendation contained herein may not be suitable for all investors as it does not take into account your personal financial needs or investment objectives. Although Veye takes the utmost care to ensure accuracy of the content and that the information is gathered and processed from reliable resources, we strongly recommend that you seek professional advice from your financial advisor or stockbroker before making any investment decision based on any of our recommendations. All the information we share represents our views on the date of publishing as stocks are subject to real time changes and therefore may change without notice. Please remember that investments can go up and down and past performance is not necessarily indicative of future returns. We request our readers not to interpret our reports as direct recommendations. To the extent permitted by law, Veye Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss, or data corruption) (as mentioned on the website www.veye.com.au), and confirms that the employees and/or associates of Veye Pty Ltd do not hold positions in any of the financial products covered on the website on the date of publishing this report. Veye Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services.