Top Trending Penny Stocks For 2024

Get your Free Report on Top 5 ASX stocks for 2025

Get your Free Report on Top 5 ASX stocks for 2025

The countdown has begun to hit the new year of 2024; it is already time to be thinking and preparing for the market cycle. Stop fretting if you do not have a lot of capital; the financial markets are a place where everyone can have a place to participate. The ASX All Ordinaries index that represents the ASX penny companies (XAO: ASX) chart below well portrays the consolidation and is poised to move upward anytime soon. From the below chart, it gives a clear indication that ASX penny stocks are getting ready to gear up and grab the “Title of 2024” as a best performer compared to any other.

Fig. : 5-year chart performance of All Ordinaries (ASX: ZAO).

Our research team strongly leverages and enables the unveiling of the power of ASX penny’ stocks for traders, and we believe these findings might trigger record performance unprecedentedly in the Australian ASX market going down the line. The confidence comes after capturing the pulses of key developmental aspects in these ASX-trending penny stocks.

Penny stock investing requires a high degree of due diligence, as their market capitalization represents a small proposition. The trait of these small-category companies is that when they ignite a fire, the rally becomes non-stoppable, and the price multiplies at a rapid pace to a multi-level higher.

Multifaceted view of “Penny Stocks”

Multi-bagger penny stocks without debt are rare to find at a reasonable valuation in the market. Our highly skilled ‘Veye Research Team’ haunts these special, hidden, rare penny gems that are in unwavering pursuit of growth and incredibly undervalued in the ASX market at the right time.

We closely assist in selecting these high-potential penny companies on both technical and fundamental grounds.

Multi-bagger penny stocks are the best investment to buy during the ongoing Bull Run or during reversal after the downfall, that is, bottom fishing.

The accuracy of calls depends on market timing. If the Bull Run sustains enough after investing in penny stocks, then the portfolio will tend to produce an exponential return.

Let’s look at some of the penny stocks that we perceived could have the potential to deliver phenomenal returns, as follows:

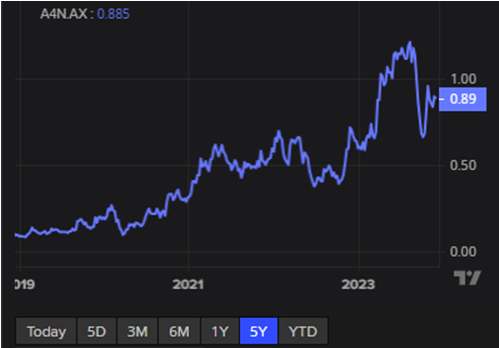

Alpha HPA Limited (ASX: A4N)

*All Data has been sourced from Company announcements and Refinitiv, Thomson Reuters

Alpha HPA Limited (ASX: A4N) has a market cap of $826.41 million and a share price of $0.885 as of December 2023. The 5-year CAGR return of All Ordinaries is approximately 5.46%, while the A4N stands at a cumulative 5-year growth rate of approximately 55.93%.

The company’s HPA circuit for Phase 1 of the HPA First Project remained on track, is expected to be fully commissioned by the end of the calendar year 2023, and will facilitate a major expansion of the production capacity of the Stage 1 PPF. This expansion will result in between 15 and 40 tpa of additional capacity for HPA production, significantly higher than the current 30 kg/day of HPA production from the facility. This increase in production will allow the company to manufacture a number of aluminum-based products at a considerable scale, such as the capability to produce additional high-purity boehmite and the capacity to produce 15–25 tpa of high-purity alumina-trihydrate, as well as synthetic sapphire using HPA as feed material. This will further be supported by the recently achieved stable production of al-nitrate, now at ~258 metric tonnes at the target 5N (99.999%) purity level, used as a precursor to be converted into

HPA once the Stage 1 HPA circuit is fully commissioned within the coming month(s).

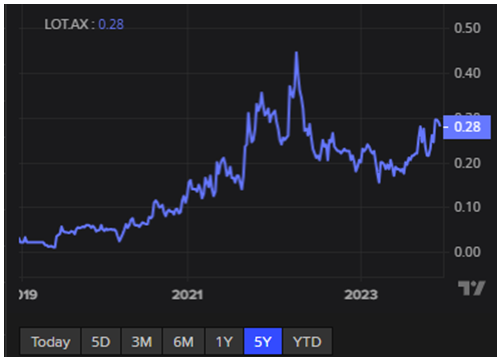

Lotus Resources Limited (ASX: LOT)

*All Data has been sourced from Company announcements and Refinitiv, Thomson Reuters

Lotus Resources Limited (ASX: LOT) has a market cap of $482.87 million and a share price of $0.28 as of 11 December 2023. The 5-year CAGR return of All Ordinaries is approximately 5.46%, while the LOT stands at a cumulative 5-year growth of approximately 66%.

Lotus’s merger with A-Cap is anticipated to be a key value catalyst as it stands to expand and scale up the company’s operating capabilities by multifold.

The company, after already witnessing a 78% increase in its Kayelekera Resource from 28.7 mlb to 51.1 mlb due to success in organic drilling and exploration activities, is anticipated to experience a further 5-fold increase in its Mineral Resources at 241 ml U3O8, making it the third largest among ASX-listed peers. This expansion in mineral resources will be facilitated by the merger with A-Cap and will create a leading uranium player with substantial production capabilities.

Atlantic Lithium Limited (ASX: A11)

*All Data has been sourced from Company announcements and Refinitiv, Thomson Reuters

Atlantic Lithium Limited (ASX: A11) has a market cap of $318.37 million and a share price of $0.52 as of 11 December 2023. The company reported a strong NPV of $1.3 billion and an IRR of 94% for its flagship Ewoyaa Lithium Project, as outlined in the DFS for the project.

The revenue-generating capabilities, resource base, and life of mine also remain strong, and further progress is being made as the ongoing drilling program increased by 43% with the addition of 8,000m of extensional resource drilling.

Frequently Asked Questions (F.A.Q)

Top trending ASX penny stocks for 2024.

Multi-bagger penny stocks without debt are rare to find at a reasonable valuation in the market. Our highly skilled ‘Veye Research Team’ haunts these special, hidden, rare penny gems that are in unwavering pursuit of growth and incredibly undervalued in the ASX market at the right time. These are as follows: Alpha HPA Limited (ASX: A4N); Atlantic Lithium Limited (ASX: A11); and Lotus Resources Limited (ASX: LOT).

Are ASX penny stocks a good investment?

ASX penny stocks are often thinly traded because of a lack of stability and fundamentals. This means that unlike the ASX large-cap shares of the ASX 200, where every stock usually has a wall of potential buyers, there may not always be enough buyer demand when investors want to sell. Additionally, penny stocks are often loss-making, using any money available to invest in growth.

What is a penny stock in Australia?

In Australia, many classify penny stocks as those under $1/share, while some use the definition loosely to describe any company with smaller share prices.

Latest Article

Checkout Our Recommendation for free - 7 day free trial

Start Free TrialDisclaimer

Veye Pty Ltd(ABN 58 623 120 865), holds (AFSL No. 523157 ). All information provided by Veye Pty Ltd through its website, reports, and newsletters is general financial product advice only and should not be considered a personal recommendation to buy or sell any asset or security. Before acting on the advice, you should consider whether it’s appropriate to you, in light of your objectives, financial situation, or needs. You should look at the Product Disclosure Statement or other offer document associated with the security or product before making a decision on acquiring the security or product. You can refer to our Terms & Conditions and Financial Services Guide for more information. Any recommendation contained herein may not be suitable for all investors as it does not take into account your personal financial needs or investment objectives. Although Veye takes the utmost care to ensure accuracy of the content and that the information is gathered and processed from reliable resources, we strongly recommend that you seek professional advice from your financial advisor or stockbroker before making any investment decision based on any of our recommendations. All the information we share represents our views on the date of publishing as stocks are subject to real time changes and therefore may change without notice. Please remember that investments can go up and down and past performance is not necessarily indicative of future returns. We request our readers not to interpret our reports as direct recommendations. To the extent permitted by law, Veye Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss, or data corruption) (as mentioned on the website www.veye.com.au), and confirms that the employees and/or associates of Veye Pty Ltd do not hold positions in any of the financial products covered on the website on the date of publishing this report. Veye Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services.