The energy from the sun can be converted into heat or electricity. This really good and clean energy can be used to make homes and businesses warm, cool, and bright. Solar photovoltaics, or solar panels, turn sunlight into electricity using a special kind of cell called a ‘semiconductor cell’ or ‘solar PV cell’. These cells are usually covered by a glass or aluminum frame that makes a solar panel. One or more solar panels can be used to power a single light, put on the roof of a house for home use, or put together to create a big solar farm that makes lots of electricity. Another type is Solar Thermal: Under this technology, sunlight is converted into heat, termed thermal energy. Solar thermal technology is further categorized as solar water heating technology, in which heat from the sun is used to provide hot water for homes and businesses. Concentrated solar thermal technology utilizes the heat from the sun to produce large-scale power generation.

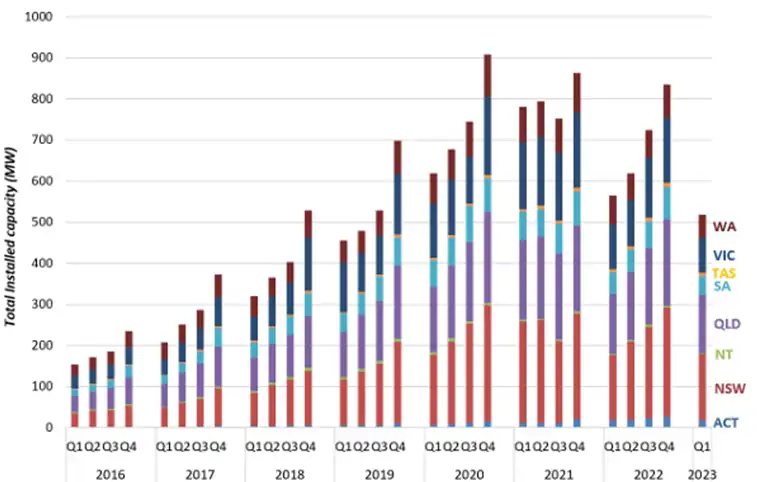

Fig: Quarterly installed capacity of rooftop solar PV in Australia.

Source: Clean Energy Regulator, Australian Energy Council.

More and more people in Australia are using solar panels on their roofs to make electricity. It is becoming a big part of how Australia gets its energy and is almost as big as coal power. At the end of the first three months of this year, rooftop solar power made up 19.8 gigawatts of capacity. This is less than the 23.3 gigawatts of capacity from coal power plants. The Clean Energy Regulator (CER) reports that in the first three months of 2023, over 62,000 new rooftop solar installations were added to the grid, bringing the total new capacity to 520 megawatts. The solar power market in Australia is forecasted to grow at a CAGR of 20.56% until 2027, largely driven by large-scale solar installations.

There are plenty of ASX companies that are making significant investments in solar energy creation, contemplating the support for a global transition to ‘net zero emissions’ by increasing the pace of pre-commercial innovation, to the benefit of Australian consumers and businesses. Here we are presenting these ASX companies as follows:

[Note]: The market cap and the share price of the selected ASX companies below are mentioned as of 5 January 2024.

Meridian Energy Limited (ASX: MEZ)

Market Cap: $13.30 billion

CMP: $5.14

MEZ engages in electricity generation, trading, and retailing, as well as the sale of related products and services. Its outlook for the period spanning from FY2024 to FY2025 paints a positive trajectory across a range of financial metrics, making it an enticing option for prospective investors. This optimistic perspective could attract investor’s interest in search of growth potential. Specifically, the EV/revenue ratio is expected to improve from 4.11x in FY2024 to 3.93x by FY25. This indicates that for each unit of revenue generated, the company's enterprise value is set to slightly decrease, suggesting potential growth in both revenue and overall valuation. Similarly, the anticipated 28.61x reduction in the PE multiple by FY25 reflects positive expectations for earnings growth.

AGL Energy Limited (ASX: AGL)

Market Cap: $6.47 billion

CMP: $9.62

AGL is set to bring two major battery projects online: the 250 MW Torrens Island Battery and the 50 MW Broken Hill Battery, both expected to commence operations this year. These projects will contribute to grid stability and support renewable energy integration.

AGL has also signed a 15-year Power Purchase Agreement (PPA) with Tilt Renewables, securing 45% of the output from the Rye Park Wind Farm in New South Wales. This equates to approximately 513 GWh of energy per year generated from 178 MW of capacity, further solidifying AGL's commitment to renewable energy and sustainability.

AGL Energy has reaffirmed its financial guidance for the fiscal year 2024, despite market conditions. The wholesale electricity forward curves for FY2025 closely resemble FY2024 pricing levels. AGL's guidance for FY2024 includes an expected underlying EBITDA range of $1,875 million to $2,175 million and an underlying net profit after tax range of $580 million to $780 million.

GENEX Power Limited (ASX: GNX)

Market Cap: $249.33 million

CMP: $0.18

Genex Power Limited secured approvals to generate 50 MW for the Bouldercombe Battery Project, perfectly timed for high energy demands in Queensland's upcoming summer. They'll start using 38 of 40 Megapacks through an agreement with Tesla Motors Australia, showing commitment to innovative energy solutions and helping Queensland's energy needs. This milestone is expected to boost Genex's revenues while supporting the state's energy system. Furthermore, their Kidston Wind agreement is a significant step towards their goal of achieving 3 GW of renewable energy by 2030, aligning with EnergyAustralia's clean energy mission.

Clearvue Technologies Limited (ASX: CPV)

Market Cap: $128.74 million

CMP: $0.56

ClearVue's ability to produce Building-Integrated Photovoltaics (BIPVs) on standard mass production lines without requiring modifications not only lowers capital costs for manufacturers but also positions the company as a cost-effective solution provider in a market where environmental regulations and carbon reduction initiatives are gaining momentum. In a world increasingly focused on sustainable building solutions and energy efficiency, ClearVue Technologies appears well-equipped to meet the growing demand for its innovative products. The company's future success will hinge on effective execution and its ability to navigate the evolving dynamics of the renewable energy and construction sectors.

Contact Energy Limited (ASX: CEN)

Market Cap: $5.84 billion

CMP: $7.41

The company has been preparing for Tauhara to come online by the end of the year, which will be very crucial. The company has been well on track to bring Te Huka 3 online by the end of 2024 and expects to take final investment decisions on Geo Future and a 100 MW battery all within this financial year. Contact Energy Limited’s dedication to laying the groundwork to realize its strategy has been intact. The company has a clear strategy, a strong balance sheet, supportive shareholders, and stands ready to execute on the opportunities to lead the de-carbonization of the New Zealand economy over the next decade.

Frequently Asked Questions (F.A.Q)

How does solar power work?

Solar photovoltaics, or solar panels, turn sunlight into electricity using a special kind of cell called a'semiconductor cell’ or'solar PV cell’. One or more solar panels can be used to power a single light, put on the roof of a house for home use, or put together to create a big solar farm that makes lots of electricity. Solar thermal technology is further categorized as solar water heating technology, in which heat from the sun is used to provide hot water for homes and businesses.

What are the advantages of solar energy?

Solar photovoltaic technology uses sunlight to make electricity that goes straight to the power grid. This allows businesses to accelerate commercial transactions by supplying extra energy to the market, which helps them save money and make extra cash. Solar energy makes jobs for people who make, build, install, and fix solar power plants. This helps the economy because families, businesses, and countries can all invest in solar power.

What are the ASX companies involved in power generation businesses?

• Meridian Energy Limited (ASX: MEZ)

• Contact Energy Limited (ASX: CEN)

• Clearvue Technologies Limited (ASX: CPV)

• GENEX Power Limited (ASX: GNX)

• AGL Energy Limited (ASX: AGL)

Veye Pty Ltd(ABN 58 623 120 865), holds (AFSL No. 523157 ). All information provided by Veye Pty Ltd through its website, reports, and newsletters is general financial product advice only and should not be considered a personal recommendation to buy or sell any asset or security. Before acting on the advice, you should consider whether it’s appropriate to you, in light of your objectives, financial situation, or needs. You should look at the Product Disclosure Statement or other offer document associated with the security or product before making a decision on acquiring the security or product. You can refer to our Terms & Conditions and Financial Services Guide for more information. Any recommendation contained herein may not be suitable for all investors as it does not take into account your personal financial needs or investment objectives. Although Veye takes the utmost care to ensure accuracy of the content and that the information is gathered and processed from reliable resources, we strongly recommend that you seek professional advice from your financial advisor or stockbroker before making any investment decision based on any of our recommendations. All the information we share represents our views on the date of publishing as stocks are subject to real time changes and therefore may change without notice. Please remember that investments can go up and down and past performance is not necessarily indicative of future returns. We request our readers not to interpret our reports as direct recommendations. To the extent permitted by law, Veye Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss, or data corruption) (as mentioned on the website www.veye.com.au), and confirms that the employees and/or associates of Veye Pty Ltd do not hold positions in any of the financial products covered on the website on the date of publishing this report. Veye Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services.