Best ASX Companies To Invest In Australia for 2024

Get your Free Report on Top 5 ASX stocks for 2025

Get your Free Report on Top 5 ASX stocks for 2025

Australia's GDP growth is anticipated to rise rapidly from early next year onwards. GDP growth is broadly reflecting the stronger increase in household consumption coupled with public demand. Household consumption growth is expected to shoot up to around its pre-pandemic average by late 2024, supported by a strong renaissance in real income growth.

Australia seems to be increasing substantial investment in the upcoming years. This mainly reflects ongoing progress through the pipeline of work to be done as capacity constraints are expected to continue to ease, besides the demand surge in new housing boosted by population growth.

Employment growth is expected to remain positive going forward; however, due to the resilient outlook for economic activity, the unemployment rate is expected to pick up gradually.

After passing through the difficult phases of 2022 and 2023, a sustainable balance between supply and demand in the labour market and the economy is likely to set inflation numbers at a low level. Overall, progress solidifies and directs an indication of optimism for the New Year’s opportunities in the Australian market.

Source: Reserve Bank of Australia

Let's take a look at some of the best ASX companies with strong value propositions, a good business plan, and poised for upside potential.

Note: The market cap and the share price of the selected ASX companies below are mentioned as of 27 December 2023.

Medibank Private Limited (ASX: MPL)

Market Cap: $9.78 billion

Share price: $3.55

Medibank Private Limited (ASX: MPL) is primarily involved in the underwriting and distribution of PHI policies through its two brands, Medibank and AHM.

The company mainly targets key areas of its business, such as organic and inorganic growth for Medibank Health and Health Insurance. The company is maintaining strong, evolving relationships with the hospitals, and more importantly, partnership models are the key to its growth strategy. The company expects further benefits from ADR over the next five years, and given the strong position in the family market, it anticipates the percentage of lives insured that are less than 30 years of age to increase. MPL has a strong determination to grow its market share by further capitalising on its dual-brand strategy.

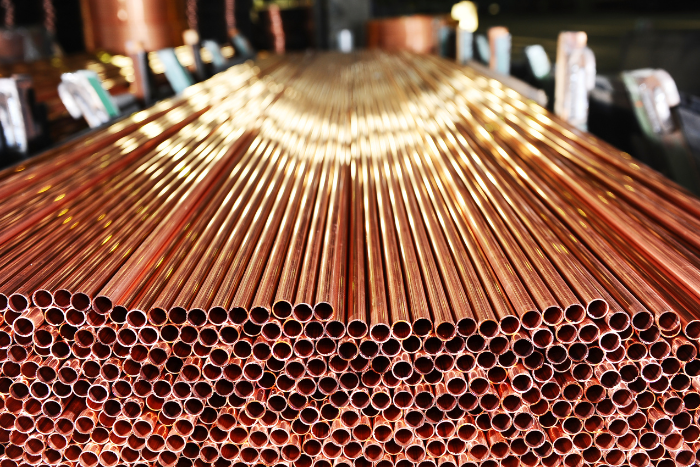

Sandfire Resources Limited (ASX: SFR)

Market cap: $3.22 billion

Share price: $7.04

Sandfire Resources Limited (ASX: SFR) is basically involved in the production and sale of copper concentrate, gold, and silver from its key resource base.

The company continued to advance its research for the high-grade extension of the Johnny Lee deposit at Black Butte. Another prospect that will help increase copper production is expected from the resource drilling underway at A1, and the maiden resource is anticipated in Q3 FY2024.

Mystate Limited (ASX: MYS)

Market Cap: $338.55 million

Share price: $3.07

Mystate Limited (ASX: MYS) is a provider of banking, trusteeship, and wealth management services domestically as well as internationally.

The growth in customers, deposits, and lending allowed the company to make a recovery in its financial performance after witnessing a slight decline in FY2022, eventually resulting in record revenues and net profits for MyState. The constantly expanding asset base has also enabled significant growth in the book value and led to a price-to-book ratio of 0.74, signifying excellent feasibility and value for money in the investment, especially considering that almost 99% of the company’s assets are earning assets, with a majority of them comprising loans and advances. This indicates further improvement in the book value and positive price momentum with the expanding loan book.

Reference: *All Data has been sourced from Company announcements and Refinitiv, Thomson Reuters

Frequently Asked Questions (F.A.Q)

What is the fundamental of the ASX: MPL?

Medibank Private Limited remains well-positioned for growth with strong customer advocacy, an upsurge in policyholders, a track record of health innovation, a continued focus on cost discipline, and a strong balance sheet to support growth ambitions. The revenue growth year on year is in an incremental order, which indicates the potential for strong resilience in financial performance despite the prevailing challenges in the market. The company did exceptionally well in terms of growth in net profit after tax, suggesting an increased profit margin. The balance sheet realizes an increase in the net tangible assets per share. The liquidity ratios provide enough justification for the capabilities of short-term obligations. The debt-to-asset ratio, along with the net tangible assets per share, indicates the potential for a good margin of safety for the investment.

What are the fundamentals of SFR?

Sandfire Resources Limited has been fundamentally strong, as the balance sheet contains cash and cash equivalents of $113 million. The Q1 FY2024 outcome of underlying group EBITDA reported at $66 million is a clear indication of strong operational activity to continue even further. The company has been incredibly well positioned to create strong value for shareholders by delivering safe, consistent, and predictable performance and further reducing carbon intensity. Materially increasing reserves in the provinces, the company has stood boldly for exploration potential. On a relative valuation front, the price-to-book value of 1.06x offers an attractive value proposition.

What are the best ASX companies to look at in the new year?

Some of the best prospects to look at are:

• Mystate Limited (ASX: MYS)

• Medibank Private Limited (ASX: MPL)

• Sandfire Resources Limited (ASX: SFR)

Latest Article

Checkout Our Recommendation for free - 7 days free trial

Start Free TrialDisclaimer

Veye Pty Ltd(ABN 58 623 120 865), holds (AFSL No. 523157 ). All information provided by Veye Pty Ltd through its website, reports, and newsletters is general financial product advice only and should not be considered a personal recommendation to buy or sell any asset or security. Before acting on the advice, you should consider whether it’s appropriate to you, in light of your objectives, financial situation, or needs. You should look at the Product Disclosure Statement or other offer document associated with the security or product before making a decision on acquiring the security or product. You can refer to our Terms & Conditions and Financial Services Guide for more information. Any recommendation contained herein may not be suitable for all investors as it does not take into account your personal financial needs or investment objectives. Although Veye takes the utmost care to ensure accuracy of the content and that the information is gathered and processed from reliable resources, we strongly recommend that you seek professional advice from your financial advisor or stockbroker before making any investment decision based on any of our recommendations. All the information we share represents our views on the date of publishing as stocks are subject to real time changes and therefore may change without notice. Please remember that investments can go up and down and past performance is not necessarily indicative of future returns. We request our readers not to interpret our reports as direct recommendations. To the extent permitted by law, Veye Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss, or data corruption) (as mentioned on the website www.veye.com.au), and confirms that the employees and/or associates of Veye Pty Ltd do not hold positions in any of the financial products covered on the website on the date of publishing this report. Veye Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services.