The price of copper is expected to average around US$8,300 a ton in the second half of 2023. Lead indicators suggest near-term weakness in global manufacturing and in construction activity in key markets such as Europe. China is also expected to face further challenges in its manufacturing and construction sectors in the coming months that will act as a further drag on global demand in the near term.

The IEA, as part of its Global EV Outlook 2023, expects a significant ramp-up in the second half of the year, with global sales projected to reach 14 million units for the full year 2023. This comes despite lingering weakness in the broader global automotive sector, and we would see electric vehicles account for close to 1 in 5 car sales across the full calendar year. Copper consumption is expected to grow by 1.9% annually to 2025, supported by the considerable infrastructure works planned or underway in key regions (particularly from the energy sector), as well as the continuing penetration of EVs in the global automotive sector. Global refined copper production is forecast to reach around 27.1 million metric ton in 2023 and grow by around 0.7% annually through 2025. This is expected to be led by new capacity buildouts in China and India. Australia holds a massive resources of world’s copper.

Australia copper Outlook:

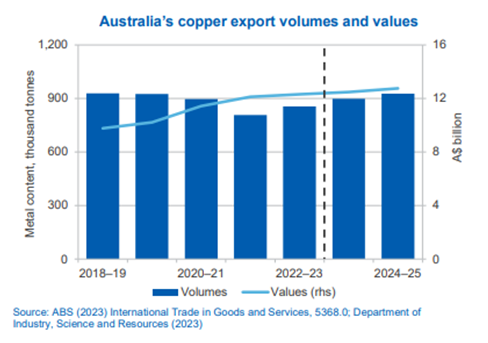

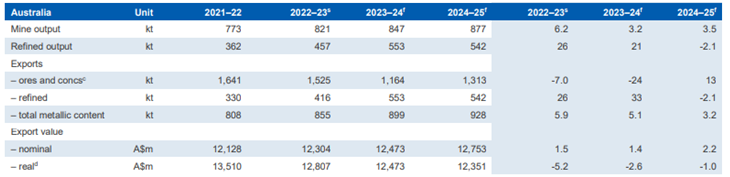

Australian export volumes are set to rise further, to reach around 928,000 ton in 2024–25. The gains in export volumes are expected to contribute to export earnings of around $12.5 billion in 2023–24 and $12.8 billion in 2024–25. Mined production is expected to grow over the outlook period to reach around 877,000 ton in 2024–25. Australia’s refined copper production is also expected to grow by around 8.9% annually to 2024–25, reaching around 540,000 ton.

Source: ABS (2023) International Trade, 5465.0; LME (2023) spot price; World Bureau of Metal Statistics (2023); Department of Industry, Science and Resources (2023).

Global EV sales are a key growth sector for copper demand over the outlook.

Global passenger and light-duty EV sales are estimated to have reached 5.7 million units in the first half of 2023, around 35% higher year-on-year. China, which only represented around 60% of the market in 2022, continues to see strong growth in 2023, reaching more than 3 million units sold in the first half of the year at an annual growth rate of over 30%. Amongst other major consumer markets, European sales grew by 25%, while the U.S. saw growth of over 50% year-on-year. The strong results observed in emerging EV consumer markets included a tripling in collective sales for India, Thailand, and Indonesia.

3: Copper stocks on the ASX

Let’s take a look at some of the best ASX copper stocks that are highly engaged in copper production in Australia and elsewhere. These are as follows:

Chalice Mining Limited (ASX: CHN), with a market capitalization of $639.84 million and a current market price of $1.645 as of 6 December 2023;is having a fully owned Gonneville Nickel-Copper-Platinum Group Element (PGE) Project.

For the quarter that ended on 30 June 2023, Chalice Mining successfully secured approximately AUD76 million in funding through a combination of an institutional placement and a share purchase plan. Furthermore, the acquisition of Chalice Mining's Hawkstone Project by Stavely Minerals is a strategic move that brings several advantages to Chalice Mining.

Evolution Mining Limited (ASX: EVN) has a market capitalization of $6.61 billion and a current market price of $3.60 as of 6 December 2023.

The revenues increased by 7.8%, from $2.06 billion in 2022 to $2.22 billion in 2023. The profits declined by 49%, from $323.3 million in 2022 to $163.5 million in 2023. The EPS also fell from 17.74 cents to 8.91 cents between the respective periods.

The company reported total assets worth $6.75 billion and total liabilities worth $3.45 billion, resulting in a debt-to-asset ratio of 0.51. The final cash balances stood at $46 million as of 30 June 2023, down 91% from $572 million at the end of the same period last year.

Sandfire Resources Limited (ASX: SFR) has a market capitalization of $2.92 billion and a current market price of $6.38 as of 6 December 2023.

The metals sales recorded at MATSA were aligned to metal production, with 14,001ton of copper, 15,064t of zinc, 1,813t of lead, and 406 koz of silver sold in the September quarter 2023. The underlying mine operating costs at MATSA were reported to have reduced by 7% from the June 2023 quarter to US$82 million, reflecting the modest improvement in productivity and efficiency.

The company will substantially capitalize on its copper equivalent production growth of 50% from continuing operations across the two years to the end of FY2025. It has planned for expansion in the Motheo 5.2 Mtpa, which is a low-cost project, for which necessary actions are being taken to ramp up the processing facility.

Frequently Asked Questions (F.A.Q)

What is the copper outlook for 2024?

Copper consumption is expected to grow by 1.9% annually to 2025, supported by the considerable infrastructure works planned or underway in key regions (particularly in the energy sector) as well as the continuing penetration of EVs in the global automotive sector. Global refined copper production is forecast to reach around 27.1 million metric ton in 2023 and grow by around 0.7% annually through 2025.

Is there a copper ETF on the ASX?

Global X ETFs Australia has launched the Global X Copper Miners ETF on the ASX in 2022 due to rising demand for copper.

What is the biggest ASX copper-based company?

BHP Group Limited, with a market capitalization of $239.40 billion and a current market price of $47.23, is one of the biggest ASX copper companies in Australia.

What ASX companies mine copper?

Australian companies are notably participating in economic growth through the abundance of copper resource availability in Australia. Examples of some ASX companies include Evolution Mining Limited, Sandfire Resources Limited, Zimplates Holdings Limited, and Chalice Mining Limited.

Veye Pty Ltd(ABN 58 623 120 865), holds (AFSL No. 523157 ). All information provided by Veye Pty Ltd through its website, reports, and newsletters is general financial product advice only and should not be considered a personal recommendation to buy or sell any asset or security. Before acting on the advice, you should consider whether it’s appropriate to you, in light of your objectives, financial situation, or needs. You should look at the Product Disclosure Statement or other offer document associated with the security or product before making a decision on acquiring the security or product. You can refer to our Terms & Conditions and Financial Services Guide for more information. Any recommendation contained herein may not be suitable for all investors as it does not take into account your personal financial needs or investment objectives. Although Veye takes the utmost care to ensure accuracy of the content and that the information is gathered and processed from reliable resources, we strongly recommend that you seek professional advice from your financial advisor or stockbroker before making any investment decision based on any of our recommendations. All the information we share represents our views on the date of publishing as stocks are subject to real time changes and therefore may change without notice. Please remember that investments can go up and down and past performance is not necessarily indicative of future returns. We request our readers not to interpret our reports as direct recommendations. To the extent permitted by law, Veye Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss, or data corruption) (as mentioned on the website www.veye.com.au), and confirms that the employees and/or associates of Veye Pty Ltd do not hold positions in any of the financial products covered on the website on the date of publishing this report. Veye Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services.