Fig: ASX 200 1 Year chart

Source: Yahoofinance.com

The year ended with a bumper gain of around 9.5% on the broader market, the ASX 200 (from January 1, 2023 to December 31, 2023). The ASX market is hovering near all-time highs and remains poised to go even higher. The year was filled with enormous challenges such as higher interest rates, higher cost of living crises and geopolitical conflicts. Despite this, the year ended on a promising and positive note. The ASX stock market is also on track to regain its previous high reached in August 2021 at 7,629 points. The market is well prepared to reach new highs with notable ideas in 2024. Metal stocks, technology companies and financial companies are all gathering to look at the importance and the performance of the broader index.

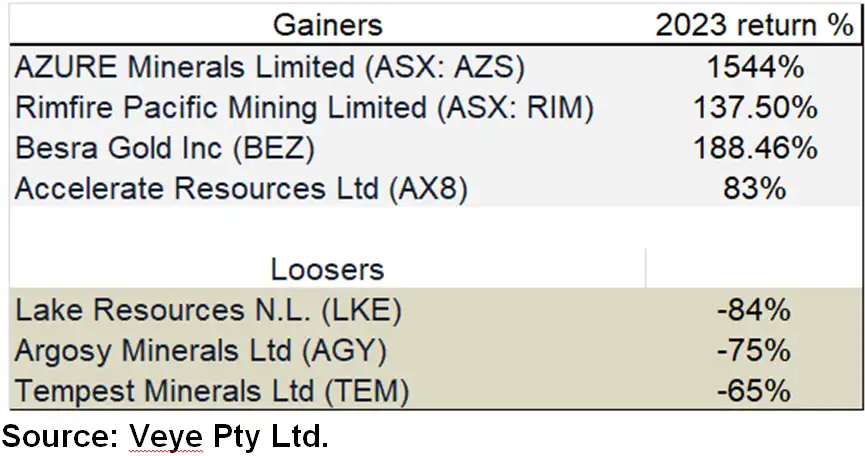

Now, let’s look at some of the 2023 gainers and losers on the index.

2023 Top Gainers

2023 Top Gainers

Note: The market cap and the share price of the selected ASX companies below are mentioned as of 2 January 2024.

AZURE Minerals Limited (ASX: AZS)

Market Cap: $1.69 billion

CMP: $3.695

Azure holds promise of great potential for the future but also currently stands in a less stable position, without significant assurance of growth to sustain in the coming years given the extreme cash flow negative position of the company and existing cash balances relative to the expected capital requirements for the development of the existing projects in the coming years. The company might also struggle to sustain the operational expenses for full-fledged production, enabling the ideal extraction of monetary value from the projects to be hampered. The company, as a result, has resorted to institutional placements on a large scale for capital inflows. Moreover, the issue price at which the shares are offered is considerably lower than the current market price even after the recent decline, still providing a lucrative position for the subscribers of the recent issue to sell, leading to a further decline in the market value of the stock.

Rimfire Pacific Mining Limited (ASX: RIM)

Market Cap: $42.18 million

CMP: $0.019

The primary focus of Rimfire’s activities over the past few months has been on securing a significant funding base along with simultaneous exploration and test work, which is anticipated to lead to a maiden MRE within the coming months. Rimfire, however, is required to carefully manage the geological complexity of its explorations, which require additional efforts from the company’s part, with the issues primarily revolving around spurious magnetic effects, lateral geochemical dispersion, and non-uniform weathering, which could also lead to disruptions in the development timeline of the project.

Top Loosers

Lake Resources N.L. (ASX: LKE)

Market Cap: $192 million

CMP: $0.135

Lake, notably, holds highly negative cash flows from its operations primarily directed towards administrative, corporate, and staff costs, along with proportional cash outflows mainly towards exploration and evaluation. This, although significant, possesses the potential to provide more than adequate returns in the coming years. This is made evident by the company’s huge resource base of lithium carbonate equivalent, allowing extraction for a long life of 25+ years while also confirming existing monetary value in the projects and acting as a strong base to gain leverage.

Argosy Minerals Limited (ASX: AGY)

Market Cap: $203.6 million

CMP: $0.145

Argosy Minerals is making significant strides with its flagship asset, the Rincon Lithium Project. Recent findings from brine samples have confirmed a thicker lithium brine-bearing layer in the deeper aquifers below the existing indicated mineral resource. This discovery is a positive sign and sets the stage for an upgraded brine mineral resource estimate, which could enhance the project's potential. The company is actively focused on reaching crucial milestones that will support its ambitious growth plans in the near term. These milestones are likely tied to various aspects of project development, including scaling up production and ensuring product quality.

Frequently Asked Questions (F.A.Q)

What are the top losers and gainers in 2023?

Top gainers:

Northern Star Resources Limited (ASX: NST)

Anglogold Ashanti Ltd (AGG)

Besra Gold Inc (BEZ)

Accelerate Resources Ltd (AX8)

Breaker Resources NL (BRB)

Top looser:

Lake Resources N.L. (ASX: LKE)

Argosy minerals Limited (ASX: AGY)

Tempest Minerals Limited (ASX: TEM)

What to select an ASX stock for 2024?

There are many ways and parameters to help choose a business to buy. A single winning strategy is not enough. Past performance and balance sheet strength strongly support future projections.

What ASX stocks are in copper mining?

ASX conpanies contribute to economic growth especially thanks to the abundant copper resources available in Australia. Examples of some ASX companies include Evolution Mining Limited, Sandfire Resources Limited, Ziimplates Holdings Limited and Chalice Mining Limited.

Veye Pty Ltd(ABN 58 623 120 865), holds (AFSL No. 523157 ). All information provided by Veye Pty Ltd through its website, reports, and newsletters is general financial product advice only and should not be considered a personal recommendation to buy or sell any asset or security. Before acting on the advice, you should consider whether it’s appropriate to you, in light of your objectives, financial situation, or needs. You should look at the Product Disclosure Statement or other offer document associated with the security or product before making a decision on acquiring the security or product. You can refer to our Terms & Conditions and Financial Services Guide for more information. Any recommendation contained herein may not be suitable for all investors as it does not take into account your personal financial needs or investment objectives. Although Veye takes the utmost care to ensure accuracy of the content and that the information is gathered and processed from reliable resources, we strongly recommend that you seek professional advice from your financial advisor or stockbroker before making any investment decision based on any of our recommendations. All the information we share represents our views on the date of publishing as stocks are subject to real time changes and therefore may change without notice. Please remember that investments can go up and down and past performance is not necessarily indicative of future returns. We request our readers not to interpret our reports as direct recommendations. To the extent permitted by law, Veye Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss, or data corruption) (as mentioned on the website www.veye.com.au), and confirms that the employees and/or associates of Veye Pty Ltd do not hold positions in any of the financial products covered on the website on the date of publishing this report. Veye Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services.