Top Leading Australian Banks

Some of the leading banks such as:

Commonwealth Bank of Australia (CBA); Westpac Banking Corporation (WBC); ANZ Group Holdings Ltd (ANZ); and National Australia Bank Ltd (NAB), occupy the major weights in the ASX 200 Index.

Birds Eye View on ASX Banking Systems

The Australian financial system remains resilient and strongly poised to support the economy through more difficult times for households and businesses as the barrage of rate hikes by the central government tame the inflation rate back to the pre-determined target range. The banks have strong capital and liquidity positions. The robust economic activity and solid employment growth have contributed to significant profitability growth in the banks and the low level of loans over the past year. The funding markets, basically in the wholesale markets, have been tight at times as investors adapt to the rapid increases in policy rates by central banks in the midst of geopolitical tensions and the most critical economic situation. Notwithstanding, Australian banks' bond issuance has been highly supported by their strong credit ratings and the variety of funding options available. Overall, the banks’ balance sheets are expected to remain resilient to the impact of rising interest rates. In recent years, lending volumes and lower impairment charges have supported profitability. Higher interest rates have supported net interest margins through higher earnings on interest rate hedges and holding high-quality liquid assets.

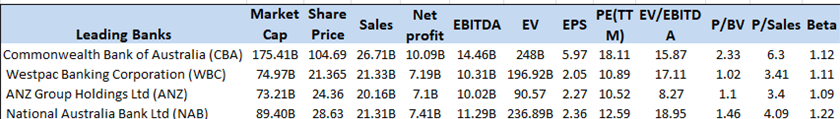

Comparative analytics of the leading banks:

Note: Market cap and share price are taken as of 5 December 2023. The sales and net profit numbers are taken as of 30 September 2023 except for CBA: 30 June 2023). Overall, tentative values are considered for a comparable purpose.

(Graphic Source – Company Reports)

As we can see from the above table, the differential market cap clearly indicates that Commonwealth Bank of Australia has a distinctive position in the Australian banking space. The financial numbers and enterprise value also provide a remarkable and well-differentiated position. The beta values of all the respective banks are relatively close, signaling moderate risk. On a relative valuation front, the price-to-sales value of CBA trades at 6.3x multiple, suggesting a strong investor interest in paying a higher premium at a given par $1 sales value, which gives a notion of a higher valuation. The price-to-book value of CBA trades at a multiple of 2.33x, which is comparatively higher than its other peers. On the EV/EBITDA front, the ANZ trade at a multiple of 8.27x, which is a significantly lower valuation, offers a better buying perspective than others. On a historical basis, the comparable enterprise values of WBC and ANZ of 196.92B and 90.57B, respectively, provide an accurate picture of investors' preference for WBC over ANZ. Overall, on a major correction of such banks, it is always wise to keep them in the portfolio.

Frequently Asked Questions (F.A.Q)

What are the leading banks in Australia?

Some of the leading banks, such as Commonwealth Bank of Australia (CBA), Westpac Banking Corporation (WBC), ANZ Group Holdings Ltd. (ANZ), and National Australia Bank Ltd. (NAB), occupy the major weights in the ASX 200 Index.

Why is WBC a better bank than ANZ?

On a historical basis, the comparable enterprise values of WBC and ANZ of 196.92B and 90.57B, respectively, provide an accurate picture of investors' preference for WBC over ANZ.

What are Tier 1 banks in Australia?

Some of the major Australian banks are well placed in the Tier-1 category, having less risk in their lending activities. These are as follows: Commonwealth Bank of Australia (CBA); Westpac Banking Corporation (WBC); ANZ Group Holdings Ltd. (ANZ); and National Australia Bank Ltd. (NAB).

Veye Pty Ltd(ABN 58 623 120 865), holds (AFSL No. 523157 ). All information provided by Veye Pty Ltd through its website, reports, and newsletters is general financial product advice only and should not be considered a personal recommendation to buy or sell any asset or security. Before acting on the advice, you should consider whether it’s appropriate to you, in light of your objectives, financial situation, or needs. You should look at the Product Disclosure Statement or other offer document associated with the security or product before making a decision on acquiring the security or product. You can refer to our Terms & Conditions and Financial Services Guide for more information. Any recommendation contained herein may not be suitable for all investors as it does not take into account your personal financial needs or investment objectives. Although Veye takes the utmost care to ensure accuracy of the content and that the information is gathered and processed from reliable resources, we strongly recommend that you seek professional advice from your financial advisor or stockbroker before making any investment decision based on any of our recommendations. All the information we share represents our views on the date of publishing as stocks are subject to real time changes and therefore may change without notice. Please remember that investments can go up and down and past performance is not necessarily indicative of future returns. We request our readers not to interpret our reports as direct recommendations. To the extent permitted by law, Veye Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss, or data corruption) (as mentioned on the website www.veye.com.au), and confirms that the employees and/or associates of Veye Pty Ltd do not hold positions in any of the financial products covered on the website on the date of publishing this report. Veye Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services.