Electric Vehicle Stocks ASX

Electric vehicle usage is comparably lower in Australia than in other developed countries, but the number of EVs is expected to grow as cheaper models arrive and more charging infrastructure is rolled out.

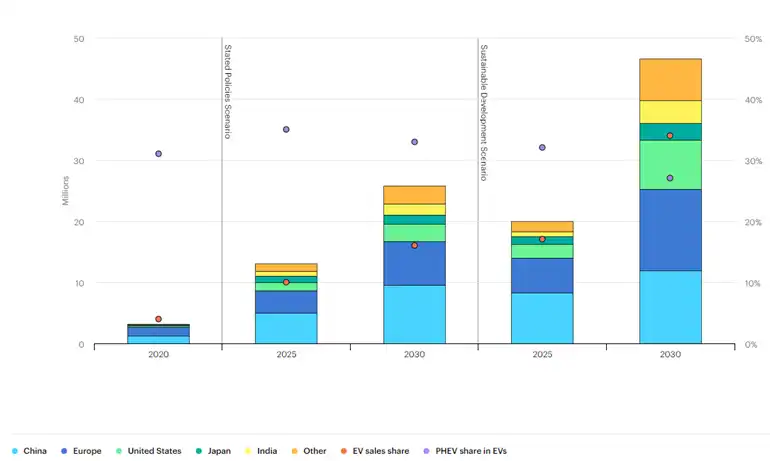

Collectively, all nations are flocking to deploy significant investment in the EV segment, which is one of the reasons why lithium as a battery mineral has taken the lead. As per the International Energy Agency's (IEA) estimates, there will be over 40x growth in lithium demand by 2040, with China leading, having the largest EV market, and with an anticipated lithium uptake of 180,000 metric tons by 2030.

However, other regions like Asia, Europe, North America, and India are also expected to witness significant growth in lithium demand as battery supply chains develop.

Source: International Energy Agency

Source: International Energy Agency

Australia's government announced its National Electric Vehicle (EV) strategy on 19 April 2023. The strategy is basically to increase affordability, facilitate access to charging stations, and substantially reduce emissions.

The South Australian government is investing $41 million, with a target to increase the pace of electric vehicle consumption in South Australia only.

The electric vehicle theme in Australia could play to a greater extent due to a revamp in the target set by the Australian government to increase the percentage share of electric vehicle sales to approximately 31% by 2030 and cover the whole pie by 2035 in a complete transition to a decarbonized transport system.

The potential increase in the EV share will drive a substantial reduction in emissions as per the first National Electric Vehicle Strategy. This strategy is well equipped with Australia’s commitments under the Paris Agreement and the Net Zero Emissions by 2050 plan.

Let’s look at some of the leading ASX companies that typically capture the growing EV theme in Australia. These are as follows:

Eagers Automotive Limited (ASX: APE)

Eagers Automotive Limited (ASX: APE) has a market capitalization of $3.69 billion and a current market price of $14.35 as of 22 December 2023.

The company estimates a strong outcome in the 2H2023 financial results. The group will produce a sustainable return on sales above 4.7% in FY2023 and beyond. It expects that the demand will be broadly in line with the industry for the full year, besides a well-balanced supply and demand environment in conjunction with a material order bank and a strong, impeccable margin. The company foresees a sustainably strong return on sales margin across the business. It believes in stepping up into oversees market and consolidating with strong networking partnerships. It’s enhancing the support system for existing OEM partners. The company focuses on constant assessment in areas such as accretive acquisition opportunities, executing Greenfield initiatives with both existing and new partners, and reviewing strategic partnerships to take notable advantages. Overall, it maintained a disciplined focus on accelerating the Next 100 strategy.

Pilbara Minerals Ltd. (ASX: PLS)

Pilbara Minerals Ltd. (ASX: PLS) has a market capitalization of $11.47 billion and a current market price of $3.81 as of 22 December 2023.

The company has set out an elaborate expansion plan and has taken substantial measures to achieve it. The expansion plan targets the planned production to increase to 1 million tpa in 2025, which will make the operation the second largest producing hard rock lithium mine in the world. The expansion project (P1000) involves a series of upgrades to the Pilgan Plant’s concentrator and a range of supporting infrastructure. The company’s JVs are precisely targeted to facilitate the same.

Magnis Energy Technologies Limited (ASX: MNS)

Magnis Energy Technologies Limited (ASX: MNS) has a market cap of $50.38 million and a current market price of $0.042 as of 22 December 2023.

The Nachu graphite project in Tanzania, where construction of the eco-village was under progress, is mostly complete, with resettlement (as part of the Resettlement Action Plan) to take place in Q3 FY2023.

For the funding of the Nachu graphite project, experienced industry legal and financial consultants were appointed. The group is in continuous negotiations with the Tanzanian government, with results to be concluded in 3Q FY 2023. MNS is working strategically towards integrating lithium-ion battery technology and developing partnerships in the main segments of its supply chain.

*All Data has been sourced from Company announcements and Refinitiv, Thomson Reuters

F.A.Q About Electric Vehicle Stocks ASX

What are the best EV stocks to buy?

Let’s look at some of the best ASX stocks in the EV theme.

• Eagers Automotive Limited (ASX:APE)

• Magnis Energy Technologies Limited (ASX: MNS)

• Pilbara Minerals Ltd. (ASX: PLS)

How big is the electric car market in Australia?

As per the electric vehicle council in Australia, 46,624 electric vehicles had been sold (YTD June 2023) compared to the total number of EV sales in 2022.

Is Australia emphasizing electric cars?

Australia's government announced its National Electric Vehicle (EV) strategy on 19 April 2023. The strategy is basically to increase affordability, facilitate access to charging stations, and substantially reduce emissions.

The South Australian government is investing $41 million, with a target to increase the pace of electric vehicle consumption in South Australia only.

Veye Pty Ltd(ABN 58 623 120 865), holds (AFSL No. 523157 ). All information provided by Veye Pty Ltd through its website, reports, and newsletters is general financial product advice only and should not be considered a personal recommendation to buy or sell any asset or security. Before acting on the advice, you should consider whether it’s appropriate to you, in light of your objectives, financial situation, or needs. You should look at the Product Disclosure Statement or other offer document associated with the security or product before making a decision on acquiring the security or product. You can refer to our Terms & Conditions and Financial Services Guide for more information. Any recommendation contained herein may not be suitable for all investors as it does not take into account your personal financial needs or investment objectives. Although Veye takes the utmost care to ensure accuracy of the content and that the information is gathered and processed from reliable resources, we strongly recommend that you seek professional advice from your financial advisor or stockbroker before making any investment decision based on any of our recommendations. All the information we share represents our views on the date of publishing as stocks are subject to real time changes and therefore may change without notice. Please remember that investments can go up and down and past performance is not necessarily indicative of future returns. We request our readers not to interpret our reports as direct recommendations. To the extent permitted by law, Veye Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss, or data corruption) (as mentioned on the website www.veye.com.au), and confirms that the employees and/or associates of Veye Pty Ltd do not hold positions in any of the financial products covered on the website on the date of publishing this report. Veye Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services.