Graphite Stocks ASX are on a rise

For quite some time, metals like lithium, cobalt, and nickel have been a top picks for investors because of the boom in of electric vehicle (EV) sector. However, graphite is another metal that has a huge potential. Graphite is a critical raw material used in the production of electric vehicle (EV) batteries. Both natural and synthetic graphite is used as an intermediate product in developing anodes of lithium-ion batteries. A typical lithium-ion battery requires 10 times more graphite than lithium. An explosion in the demand for EVs will result in a continuous demand surge for graphite.

According to Suzanne Shaw of Wood Mackenzie, "Overall, we expect the total lithium-ion battery market to grow by 35 per cent in 2022 to 602 gigawatt hours. Such large growth will allow room for significant rises in both natural and synthetic graphite." According to a report by Benchmark Mineral Intelligence, in 2021 the total demand of graphite from the battery segment was 400,000 tonnes. The demand for the same is expected to increase to 3 million tonnes by 2030. The demand for synthetic graphite was 300,000 tonnes in 2021. According to the study, the demand for synthetic graphite is expected to increase to 1.5 million tonnes by 2030.

Are graphite stocks a good investment?

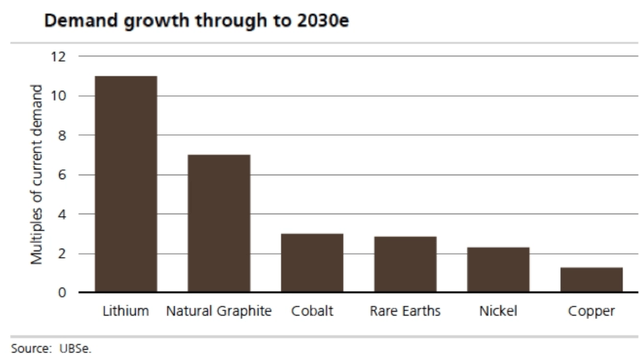

Various industry analysts and market intelligence groups have been forecasting a steady growth in demand for graphite. UBS has the following growth projection for graphite demand through 2030s:

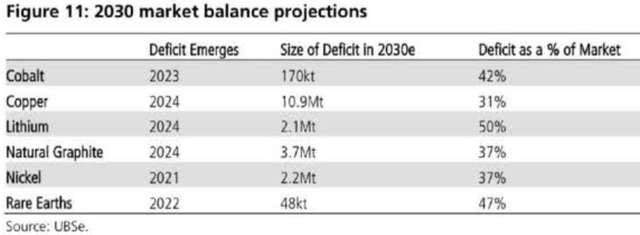

The graph clearly shows that natural graphite is expected to experience the biggest surge in demand after lithium. Such a huge demand explosion will certainly create a shortage as production capacity is unlikely to catch up the growing demand. UBS made the following forecast regarding the shortage of various metals used in EVs in the next decade:

The report expects a 37% deficit of natural graphite with respect to the market demand in the next decade. The rising demand and the consequent shortage will result in higher price for graphite. This will create a highly profitable scenarios for companies involved in graphite exploration and development.

Given the rising demand for graphite, we expect major growth in the ASX 200 graphite stocks. We have identified the following four major ASX graphite stocks in the ASX 200 which are going to benefit from soaring graphite demand:

-

1. Novonix Ltd (ASX: NVX)

About the company

Novonix is a major battery manufacturing company that develops graphite for anodes used in lithium-ion batteries.

Stock information

The previous closing price of the stock was $3.220. The 52-week high price of the stock was $12.470. The stock price had experienced a huge upside in 2021. However, it is currently trading at a around 75% discount compared to its 52-weeks high price. The current market cap of the firm is around $1.6 billion, which makes it an attractive buy at this point.

According to a report by Bloomberg, the revenue of Novonix is expected to increase by 69% year on year to $8.8 million in FY22. Also, the revenue is expected to grow by a multiple of 4.78 to $51 million in FY23 and take a leap to $141 million in FY24.

Higher revenue forecast and the correction in the stock makes it a lucrative investment option.

-

2. Syrah Resources Ltd (ASX: SYR)

About the company

Syrah Resources Ltd is a leading mining technology company. It has its flagship Balama Graphite Operation Project in Mozambique, which is considered “world’s largest natural graphite resource.” The Balama project is a gigantic high-grade, low-cost and long-life graphite mine, which is wholly owned by Syrah Resources. The expected life of the mine is greater than 50 years.

Stock information

The last closing price of the stock was $1.380. The 52-weeks high price was $2.128. Therefore, the stock is trading at around 35% discount from its 52-weeks high price.

Recently the company has been expanding into the USA. It is investing in the USA to become a vertically integrated producer of natural graphite Active Anode Material (“AAM”) in Louisiana, USA. With a rise in the price of flake graphite, the firm will be increasingly profitable.

The current market capitalization of the company is $923.83M. The current price makes it an attractive stock for accumulation with a five-year investment horizon.

About the company

Talga Group is an Australian advanced materials company producing 'anode' and 'graphene additive' products. Some of its prominent products in the market are Talnode®-C (a premium graphite anode product) and Talnode®-S (graphene silicon composite electrode additive product). The company currently owns a number of graphite projects in northern Sweden.

Stock information

The previous closing price of the stock was $1.240. The 52-weeks high price of the stock was $2.230. Therefore, the stock is currently trading at a huge discount from its 52-233ks high price.

The vertical integration of the company in Europe makes it a very promising stocks in the graphite sector. The main strategy of the firm is to produce anodes in Europe. Such a strategy is expected to be very lucrative in the long run because of the planned battery giga factories coming to Europe.

The company has a market cap of $266.63M and the company has zero net debt. It has strong fundamentals, which makes it a promising stock in the graphite segment.

-

4. Black Rock Mining Ltd (ASX: BKT)

About the company

Black Rock Mining is an Australian mining company. The company is involved in developing the Mahenge Graphite Project in Tanzania. The Mahenge Project is considered the fourth largest graphite source in the world. It is a rich source of multi-generational graphite resource and a major source of JORC-compliant flake graphite resources globally. The feasibility project of the firm forecasts a four-stage construction schedule to deliver up to 340,000 tonnes per annum of 98.5% graphite concentrate for 26 years.

Stock Information

The previous closing price of the stock was $0.1900. The 52-weeks high price of the stock was $0.3300. The stock experienced a stellar performance in 2021. The current market capitalization of the company Is $185.679M

Many metal and mining analysts in Australia expect the company to achieve break-even in 2023 and earn a positive profit of $4.7 million in 2024. The company also does not have any debt in its balance sheet, which is a positive factor for the stock. In addition, the experienced management team of the company boosts shareholders’ confidence.

Veye Pty Ltd(ABN 58 623 120 865), holds (AFSL No. 523157 ). All information provided by Veye Pty Ltd through its website, reports, and newsletters is general financial product advice only and should not be considered a personal recommendation to buy or sell any asset or security. Before acting on the advice, you should consider whether it’s appropriate to you, in light of your objectives, financial situation, or needs. You should look at the Product Disclosure Statement or other offer document associated with the security or product before making a decision on acquiring the security or product. You can refer to our Terms & Conditions and Financial Services Guide for more information. Any recommendation contained herein may not be suitable for all investors as it does not take into account your personal financial needs or investment objectives. Although Veye takes the utmost care to ensure accuracy of the content and that the information is gathered and processed from reliable resources, we strongly recommend that you seek professional advice from your financial advisor or stockbroker before making any investment decision based on any of our recommendations. All the information we share represents our views on the date of publishing as stocks are subject to real time changes and therefore may change without notice. Please remember that investments can go up and down and past performance is not necessarily indicative of future returns. We request our readers not to interpret our reports as direct recommendations. To the extent permitted by law, Veye Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss, or data corruption) (as mentioned on the website www.veye.com.au), and confirms that the employees and/or associates of Veye Pty Ltd do not hold positions in any of the financial products covered on the website on the date of publishing this report. Veye Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services.