Top 5 ASX Education & Training Stocks 2024

Get your Free Report on Top 5 ASX stocks for 2025

Get your Free Report on Top 5 ASX stocks for 2025

"Education is the most powerful weapon that you can use to change the world."- Nelson Mandela.

In Australia, there is a growing need for qualified teachers and educators, and more job opportunities are opening up annually in these fields.

One of the sectors in Australia that is expanding the fastest is ‘education’. More than 1.12 million people work there. According to the Australian government, the demand for educators and training professionals in general will continue to rise and is predicted to reach more than 10% growth by 2027.

Source: Department of Foreign Affairs and Trade

Australia's educational system is known throughout the world for its high standards and excellence. The $20 billion export sector, which draws in foreign students from all over the world, is regarded as an essential asset for Australian society. Australia is home to the third-highest number of international students, after the US and the UK. Preschools, elementary and secondary schools, universities, other tertiary institutions (like TAFEs), and a variety of programs that assist adult education are all part of Australia's well-developed educational system. According to the Australian Bureau of Statistics, there are approximately 276,329 teachers and 95,995 support and clerical employees employed in Australia's educational system. In Australia, there are over 1,200 educational establishments that provide about 22,000 courses on everything from cake decorating to engineering.

The Australian government recently announced the creation of a task force for the recognition of educational qualifications, in keeping with its Strategy for International Education 2021–2030, which aims to enhance bilateral education cooperation and the growth of offshore educational services.

Let's take a look at a few of the major ASX companies involved in the training and education sector. These are listed in the following order:

[Note]: The market cap and the share price of the selected ASX companies below are mentioned as of 11 January 2024.

Kip McGrath Education Centres Limited (ASX: KME)

Market Cap: $27.57 million

CMP: $0.485

• Kip McGrath Education Centres Limited is driving growth through its four strategic levers. One of these is by increasing students per center. As it is, the company’s high-quality, small-group tutoring and blended learning options are being strongly appreciated by parents and students, leading to the success of its lesson growth.

• The strong demand can be highlighted by the fact that over two million lessons were delivered this year. Achieving an 11% increase in average student numbers for corporate centres, it has begun the rollout of its revolutionary KipLearn tutoring platform to enhance reach and impact. The second avenue for growth is by increasing the number of centres in existing markets, with a focus on underpenetrated major and large secondary cities in Australia and the UK.

Keypath Education International Inc. (ASX: KED)

Market Cap: $77.29 million

CMP: $0.36

The number of new programs in KED's pipeline is above expectations and at a historically high level. Keypath is in a good position to grow its technology and services globally and support universities in their efforts to offer high-quality education in a digital setting. With 33 new programs, including ones in Southeast Asia, and five new partners signed, KED is still moving forward as planned. The expansion of social services and healthcare, including nursing, is what's driving growth and the pipeline for new programs.

Kneomedia Limited (ASX: KNM)

Market Cap: $4.60 million

CMP: $0.003

Since more and more public schools in New York City are implementing the KneoWorld platform, a large amount of resources was set aside to make sure that as many schools as possible were using the software. There are currently 80 public schools in New York City and New York State that use the KneoWorld program. Although relatively acceptable, the increasing adoption of the technology is serving as a great benchmark and additional assurance for other US states, including New York City, New York State, and other states that wish to implement the platform.

IDP Education Limited (ASX: IEL)

Market Cap: $5.81 billion

CMP: $20.89

As global mobility resumed, IDP clients expressed their aspirations to travel abroad. Over the course of the year, the company's global Net Promoter Score increased by four points, indicating that it improved its customer relationships. The expansion of IDP's digital platform and geographic reach is indicative of its multifaceted, Omni-channel strategy.

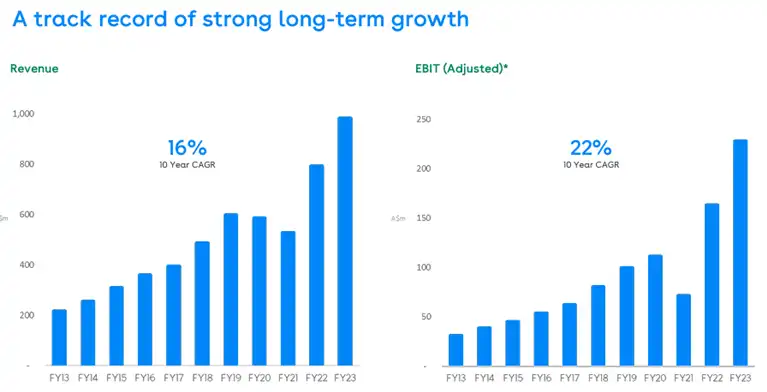

Revenue has been growing at a CAGR of 16% in the last 10 years, and a CAGR of 22% growth rate in the last 10 years is accounted for in adjusted EBIT.

Janison Education Group Limited (ASX: JAN)

Market Cap: $64.81 million

CMP: $0.255

Janison Education Group's recent partnership with the Australian Institute of Company Directors (AICD) to deliver online exams for the Company Directors Course and Foundations of Directorship represents a promising revenue stream starting in Q2 FY24. Additionally, Janison has a substantial pipeline of major strategic deals in the tender phase, with announcements anticipated in the second half of FY24.

Furthermore, international ICAS sitting windows in Q2 and Q4 FY24, along with international past paper sales, are expected to contribute to revenue growth in the upcoming fiscal year. The company's successful collaboration with Sydney University and its strong brand presence via social media initiatives offer opportunities for further expansion in the Asia-Pacific (APAC) region.

Reference:- *All Data has been sourced from Company announcements and Refinitiv, Thomson Reuters

Frequently Asked Questions (F.A.Q)

What are the best ASX companies involved in the education and training industry?

• Kip McGrath Education Centres Limited (ASX: KME)

• Janison Education Group Limited (ASX: JAN)

• IDP Education Limited (ASX: IEL)

• Kneomedia Limited (ASX: KNM)

Does Australian government extending any helping hands in this industry?

The Australian government recently announced the creation of a task force for the recognition of educational qualifications, in keeping with its Strategy for International Education 2021–2030, which aims to enhance bilateral education cooperation and the growth of offshore educational services.

What’s the fundamental of IDP Education Limited?

(Graphic Source – Company Reports)

(Graphic Source – Company Reports)

Revenue has been growing at a CAGR of 16% in the last 10 years, and a CAGR of 22% growth rate in the last 10 years is accounted for in adjusted EBIT.

Latest Article

Checkout Our Recommendation for free - 7 days free trial

Start Free TrialDisclaimer

Veye Pty Ltd(ABN 58 623 120 865), holds (AFSL No. 523157 ). All information provided by Veye Pty Ltd through its website, reports, and newsletters is general financial product advice only and should not be considered a personal recommendation to buy or sell any asset or security. Before acting on the advice, you should consider whether it’s appropriate to you, in light of your objectives, financial situation, or needs. You should look at the Product Disclosure Statement or other offer document associated with the security or product before making a decision on acquiring the security or product. You can refer to our Terms & Conditions and Financial Services Guide for more information. Any recommendation contained herein may not be suitable for all investors as it does not take into account your personal financial needs or investment objectives. Although Veye takes the utmost care to ensure accuracy of the content and that the information is gathered and processed from reliable resources, we strongly recommend that you seek professional advice from your financial advisor or stockbroker before making any investment decision based on any of our recommendations. All the information we share represents our views on the date of publishing as stocks are subject to real time changes and therefore may change without notice. Please remember that investments can go up and down and past performance is not necessarily indicative of future returns. We request our readers not to interpret our reports as direct recommendations. To the extent permitted by law, Veye Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss, or data corruption) (as mentioned on the website www.veye.com.au), and confirms that the employees and/or associates of Veye Pty Ltd do not hold positions in any of the financial products covered on the website on the date of publishing this report. Veye Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services.