Understanding PE as an investing strategy

What is PE ratio?

PE = price/earnings per share (EPS)

The equity analyst uses the metric for valuation comparative analysis to recognize the stocks available at a reasonable valuation or pricing at a higher level compared to their earnings. From the investor’s point of view, how much is an investor willing to invest for every dollar of earnings by the company? Price-to-earnings ratio is a tool mainly used to do analytics for different purposes while buying stocks, as follows:

Comparative analysis of the stock’s price in a similar industry.

Evaluation of the stocks is fundamental to derive whether they are ‘undervalued’ or ‘overvalued’.

Proceed with judgement on stock, whether to ‘hold’ or ‘sell' based on the pricing.

PE ratio example

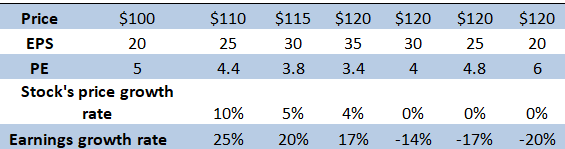

(Graphic Source – Veye Pty Ltd)

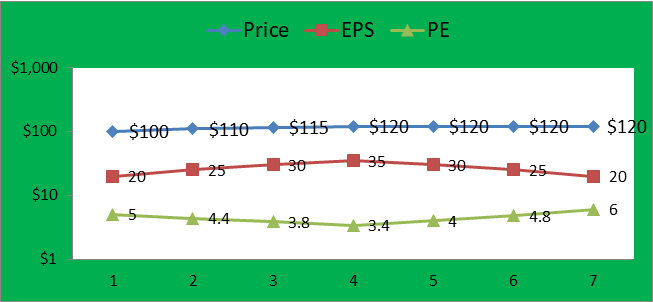

(Graphic Source – Veye Pty Ltd)

The tabular representation delineates a good understanding of how the PE ratio gets affected when earnings are growing at 25%, 20%, and 17%, respectively, along with the share price appreciation at a higher rate. Simultaneously, when the earnings trajectory is on a negative trend, the PE multiple gets affected to trade at a higher level and the share price also becomes stable in its movement. The above example portrays the situation in an ideal case; however, the reality varies with respect to the different aspects of the market.

What is a good PE ratio?

Sometimes, even with its higher PE, a company's stock’s price tends to rally due to a better future outlook. During an economic downturn, the stock’s price tends to correct faster than the company with a lower PE. It is always a good opportunity if a company’s pricing is lower than its earnings. Let’s say a company with lower PE and higher EPS develops a better valuation perspective for buying opportunities. Stocks with a PE ratio below 15 are generally considered cheap, and those with a PE ratio above 25 are considered a bit expensive. However, there are other factors that need to be taken care of. ASX 200 stocks might deserve a premium share price and, hence, a higher PE. In fact, there are stocks in the penny category without PE rallying up.

Trailing vs. forward PE ratio

The forward P/E ratio can be calculated using the projected future earnings ratio. The trailing P/E ratio, which is a standard form of a price-to-earnings ratio, is calculated using recent past earnings data. Investors should look into both parameters to assess the company before taking a buying position.

Frequently Asked Questions (F.A.Q)

What is a good PE ratio?

Stocks with a PE ratio below 15 are generally considered cheap, and those with a PE ratio above 25 are considered a bit expensive.

Is a PE ratio of 40 good or bad?

First of all, a PE multiple of 40x means, for every $1 that the company earns, investors are willing to invest $40 in the company. If similar companies in the same industry with better fundamentals offer a lower PE than a PE of 40x, it is expensive. PE multiples vary from industry to industry.

Is a 200 PE ratio good?

It is highly expensive; be careful when a company offers such a number. Any economic downturn or sluggish market outlook will drag down the stock price to a notable lower level. Investors holding such a company can take a longer time to recoup losses.

Is PE ratio below 5 good?

It is always important to note how much an investor is willing to pay for every dollar that the company earns. It depends on the company’s strength and its immediate outlook. The price-to-earnings ratio of 5 indicates that investors are less keen on realizing the potential of the stock and, hence, refrain from allocating their funds.

How to calculate the PE ratio?

P/E Ratio = Price per share/Earnings per Share

For an example,

XYZ company has price = $100

EPS = $5

Then, PE = Price/EPS or $100/$5

= $20 per share

Veye Pty Ltd(ABN 58 623 120 865), holds (AFSL No. 523157 ). All information provided by Veye Pty Ltd through its website, reports, and newsletters is general financial product advice only and should not be considered a personal recommendation to buy or sell any asset or security. Before acting on the advice, you should consider whether it’s appropriate to you, in light of your objectives, financial situation, or needs. You should look at the Product Disclosure Statement or other offer document associated with the security or product before making a decision on acquiring the security or product. You can refer to our Terms & Conditions and Financial Services Guide for more information. Any recommendation contained herein may not be suitable for all investors as it does not take into account your personal financial needs or investment objectives. Although Veye takes the utmost care to ensure accuracy of the content and that the information is gathered and processed from reliable resources, we strongly recommend that you seek professional advice from your financial advisor or stockbroker before making any investment decision based on any of our recommendations. All the information we share represents our views on the date of publishing as stocks are subject to real time changes and therefore may change without notice. Please remember that investments can go up and down and past performance is not necessarily indicative of future returns. We request our readers not to interpret our reports as direct recommendations. To the extent permitted by law, Veye Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss, or data corruption) (as mentioned on the website www.veye.com.au), and confirms that the employees and/or associates of Veye Pty Ltd do not hold positions in any of the financial products covered on the website on the date of publishing this report. Veye Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services.