ASX coal companies heavily rely on two types of coal; one is thermal coal, which is primarily used in electricity generation. Australia exports 75–80% of Australian thermal coal. The other one is metallurgical coal, which is primarily used to make steel and is priced at a premium to thermal coal and strongly maintains a correlation with steel production.

Let's get into the slight details of such classified coals for their demand scenario, pricing, challenges, and growth aspects:

Australia Metallurgical Coal:

Metallurgical coal export volumes are growing in Australia, offsetting lower prices. Metallurgical coal output steadied and then began to rise as persistent disruptions from weather and COVID that finally eased. The new El Nino season is likely to bring about sustained dry conditions over the remainder of 2023, though summer storms remain a risk factor for ports and shipping.

An emerging issue around labor shortages could constrain metallurgical coal production. Labor shortages are affecting mine sites but are also creating problems with rail shipment in parts of Queensland. If not mitigated, the impact is likely to grow over time.

Metallurgical and thermal coal producers face growing constraints on the availability of finance. Banks have increasingly sought to pivot away from all forms of coal in favor of renewables and related commodities.

Fig: Australia Metallurgical Coal Outlook:

Source: Australian Government Department of Science and Resources.

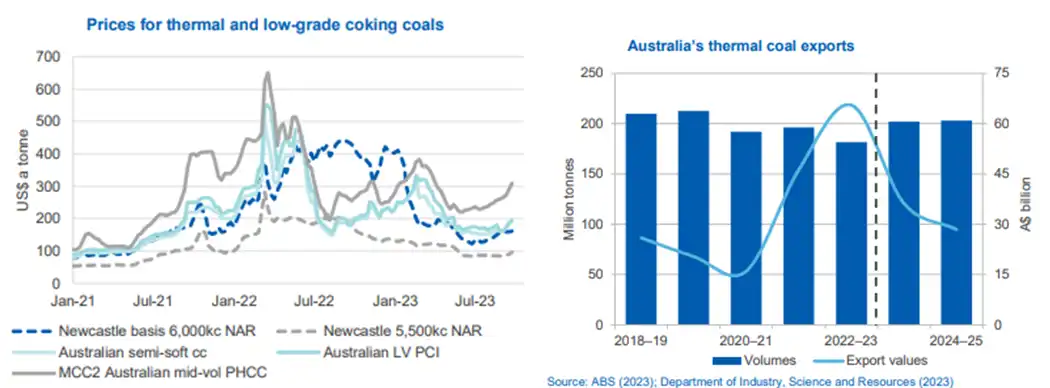

Australia Thermal Coal:

Australian thermal coal exports remain in high global demand, but supply disruptions have hampered capacity to meet it. These disruptions have included COVID-19 impacts, weather issues, and labour shortages. Labour issues are expected to grow over time, but thermal coal output is still expected to recover in the short term as weather conditions improve.

Source: Australian Government Department of Science and Resources

Fig: Australia Thermal Coal Outlook

Source: Australian Government Department of Science and Resources

Some of the well-known ASX coal companies with high market capitalization are actively participating in the exploration and development of coal in Australia. Let’s take a look at them:

Stanmore Resources Ltd. (ASX: SMR) has a market capitalization of $3.44 billion and a share price of $3.815 as 12 December 2023. The stock has delivered a 1-year exponential return of approximately 52% (YTD as of 12 December 2023).

Stanmore Resources is forecasting 2024 saleable production to be consistent with 2023 on a consolidated basis, with higher production at Poitrel offsetting changes at Isaac Plains and South Walker Creek. FOB The company’s FOB cash cost per tonne is anticipated to increase year on year due to inflation, foreign exchange movements, strip ratio changes, and other operationally related changes. The capex reflects the current pipeline, consistent with previously announced major projects.

Whitehaven Coal Ltd. (ASX: WHC) has a market capitalization of $6.14 billion and a share price of $7.34 as 12 December 2023. In the last 5 years, stock has shown compounding growth of approximately 9.61% (YTD as of 12 December 2023).

The company announced on 18 October 2023, that it had executed definitive sale agreements with BHP Group and Mitsubishi Development Pty Ltd to acquire 100% of both the Daunia and Blackwater coal mines. The aggregate cash consideration of the acquisition was US$3.2 billion.

Frequently Asked Questions (F.A.Q)

Are there any ASX coal stocks available for buying?

Supply chain bottlenecks, weather-related issues, and labour shortages hamper the production of coal, which in turn creates a price surge besides the demand growth. Some of the best billion- and million-dollar ASX coal companies may be worth buying, and these are as follows:

Stanmore Resources Limited, Bowen Coking Coal Ltd., New Hope Corporation Limited, etc.

Name the best coal miners in Australia?

Take a look at some of the mining companies actively involved in coal exploration and development. These are as follows:

Whitehaven Coal Limited, with its subsidiaries, is involved in the development, production, and operation of coal properties in New South Wales. New Hope Corporation Limited engages in the exploration, development, production, and processing of coal in Australia.

Should one ASX coal share be in Australia?

Investing in ASX markets depends on someone’s individual risk appetite and willingness to participate. It absolutely depends on someone’s own decision; it has nothing to do with us. However, Australia holds the tag of having the highest coal reserves in the world. Investors might consider the significant resource-based competitive advantages that are present with the ASX coal company’s production and development.

Which is the biggest coal field?

The biggest coal fields in Australia are the Peak Downs coal mine in the Bowen basin of central Queensland, followed by the Mt Arthur coal mine in the Hunter Valley region of New South Wales.

Veye Pty Ltd(ABN 58 623 120 865), holds (AFSL No. 523157 ). All information provided by Veye Pty Ltd through its website, reports, and newsletters is general financial product advice only and should not be considered a personal recommendation to buy or sell any asset or security. Before acting on the advice, you should consider whether it’s appropriate to you, in light of your objectives, financial situation, or needs. You should look at the Product Disclosure Statement or other offer document associated with the security or product before making a decision on acquiring the security or product. You can refer to our Terms & Conditions and Financial Services Guide for more information. Any recommendation contained herein may not be suitable for all investors as it does not take into account your personal financial needs or investment objectives. Although Veye takes the utmost care to ensure accuracy of the content and that the information is gathered and processed from reliable resources, we strongly recommend that you seek professional advice from your financial advisor or stockbroker before making any investment decision based on any of our recommendations. All the information we share represents our views on the date of publishing as stocks are subject to real time changes and therefore may change without notice. Please remember that investments can go up and down and past performance is not necessarily indicative of future returns. We request our readers not to interpret our reports as direct recommendations. To the extent permitted by law, Veye Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss, or data corruption) (as mentioned on the website www.veye.com.au), and confirms that the employees and/or associates of Veye Pty Ltd do not hold positions in any of the financial products covered on the website on the date of publishing this report. Veye Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services.