All Ordinaries (ASX: XAO).Index

The All Ordinaries stock index is market-weighted and includes about 500 companies. The index began in 1980 and is also well known in an abbreviated form as "All Ords." It is one of the most primitive indexes of shares in Australia. It is well-regarded as a total market barometer for the ASX market. The index comprises the 500 largest ASX companies and accounts for 87% of Australia's total equity market as of September 2023. It has a symbolic 3-letter exchange ticker denoted as "XAO."

The company must satisfy all the relevant requirements established by the ASX. To be inserted in the All-Ordinaries index, a company must have a market value of at least 0.2% of all domestic equities quoted on the ASX and must maintain an average turnover on the Australian exchange of at least 0.5% of its quoted shares per month.

The dividend status of All Ordinaries

The ‘All Ords’ does not take into consideration a dividend that a company distributes to their shareholders, and therefore, it is not a complete reflection of investors’ returns.

However, the All Ordinaries Total Return Index (XAOA) considers all cash dividends reinvested on the ex-dividend date, excluding franking credits, and is sometimes used as a barometer for the total investor performance of the top 250 companies by market capitalization listed on the ASX. The All Ordinaries Total Return Index was earlier known as the ‘All Ordinaries Accumulation Index’. This accumulation index is typically only used as a comparison tool for long-term investment returns and is therefore not widely quoted on a daily basis.

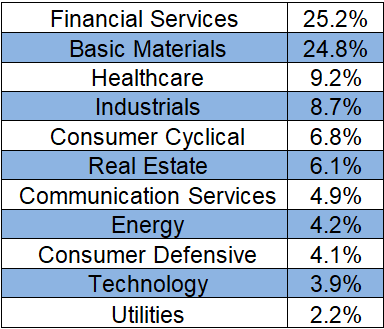

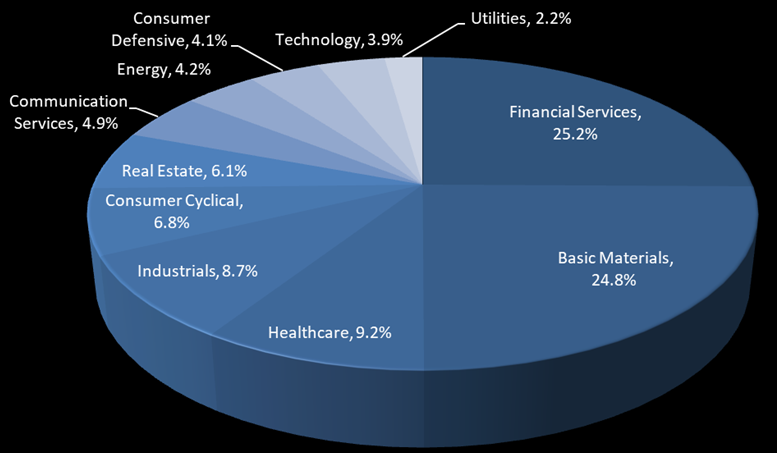

Sectoral Market Weight Percentage

Table: Calculations derived from the market capitalization of ‘All Ords’

Source: Veye Pty Limited

Source: Veye Pty Limited

Frequently Asked Questions (F.A.Q)

What is the All Ordinaries Index?

The All Ordinaries stock index is market-weighted and comprised of 500 companies from various sectors. It is also well known in an abbreviated form as "All Ords." It is one of the most primitive indexes of shares in Australia and is well-regarded as a total market barometer for the ASX market.

Does the index consider dividends?

The ‘All Ords’ does not take into consideration a dividend that a company distributes to their shareholders, and therefore, it is not a complete reflection of investors’ returns.

How do the stocks contained in the index influence the All Ords?

Companies from various sectors, from retail to resources and technology to healthcare, contribute to the index variations. The financial results and individual companies' strategic roles reflect in their share prices, influencing the overall direction of the All Ords.

Is there any exchange traded fund (ETFs)?

There are no related ETFs. The closest alternative is an ASX 300 ETF.

Veye Pty Ltd(ABN 58 623 120 865), holds (AFSL No. 523157 ). All information provided by Veye Pty Ltd through its website, reports, and newsletters is general financial product advice only and should not be considered a personal recommendation to buy or sell any asset or security. Before acting on the advice, you should consider whether it’s appropriate to you, in light of your objectives, financial situation, or needs. You should look at the Product Disclosure Statement or other offer document associated with the security or product before making a decision on acquiring the security or product. You can refer to our Terms & Conditions and Financial Services Guide for more information. Any recommendation contained herein may not be suitable for all investors as it does not take into account your personal financial needs or investment objectives. Although Veye takes the utmost care to ensure accuracy of the content and that the information is gathered and processed from reliable resources, we strongly recommend that you seek professional advice from your financial advisor or stockbroker before making any investment decision based on any of our recommendations. All the information we share represents our views on the date of publishing as stocks are subject to real time changes and therefore may change without notice. Please remember that investments can go up and down and past performance is not necessarily indicative of future returns. We request our readers not to interpret our reports as direct recommendations. To the extent permitted by law, Veye Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss, or data corruption) (as mentioned on the website www.veye.com.au), and confirms that the employees and/or associates of Veye Pty Ltd do not hold positions in any of the financial products covered on the website on the date of publishing this report. Veye Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services.